⛅ Doom and gloom are not the answer to mainstreaming climate change

Your 3-minute summary of climate tech, startups, better habits, and deep work.

Good morning, folks.

In today’s 3-minute read, we’ll cover these juicy nuggets:

📈 How are climate tech companies faring vs. the NASDAQ or S&P 500?

🎤 3 podcasts from me to you — $857M for climate tech startups

🏗️ New $500 million fund for climate tech + real estate.

⛅ Doom and gloom are not the answer to mainstreaming climate change.

💀 Want to meditate with a dead nun’s body?

If you like this newsletter, consider responding to this email with one thing you found useful. I’m here listening. 🥺🙏

— Chris

📈 How are climate tech companies faring financially vs. the NASDAQ or S&P 500?

Here’s some data to digest, along with some questions to ask yourself:

Are you surprised? — No.

Is climate change a 1- or 10- or 50-year game to win? — Yes. 🤨

—

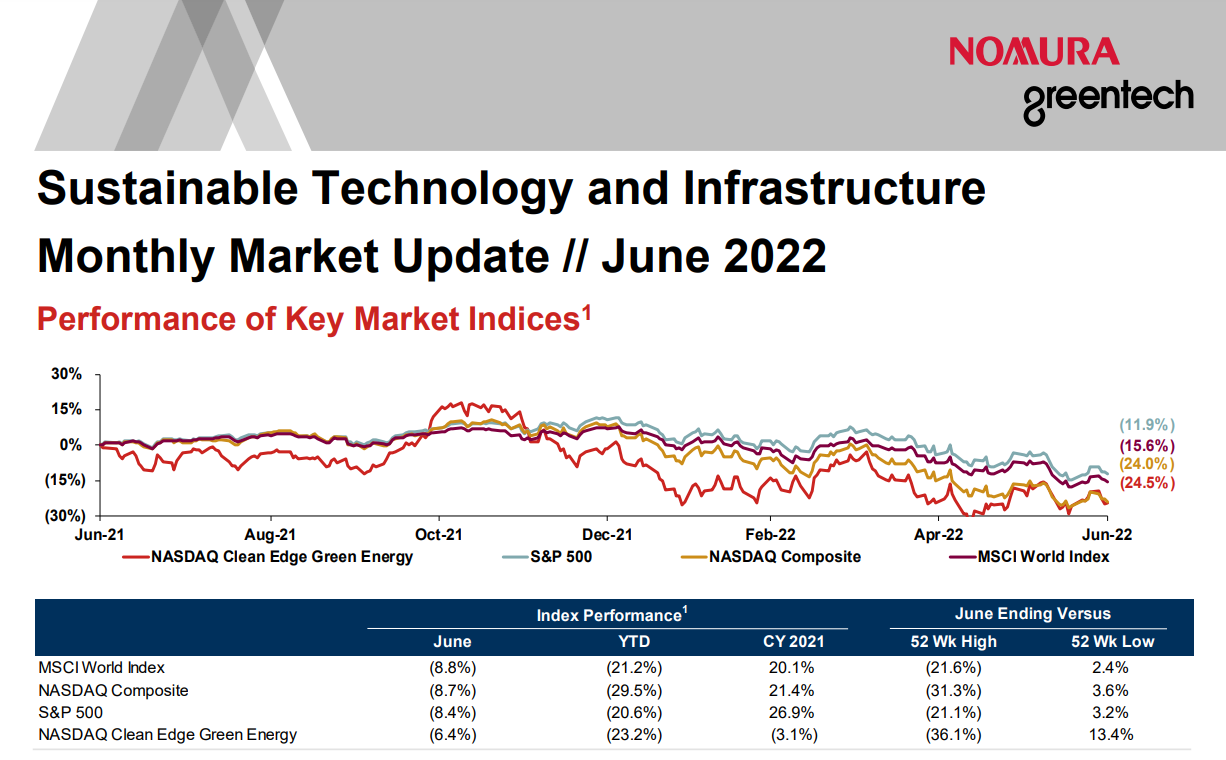

In the 1st graph from Greentech Nomura, we’re looking at the last 12 months:

The NASDAQ Clean Edge Green Energy Index (red line) is down 24.5%.

It mostly matches the NASDAQ (yellow line), which is down 24%. FWIW, Tesla has just a 7.55% weighting for this index.

But the S&P 500 (blue line) is stepping on its head, with an 11.9% positive return in the same period.

—

In this 2nd graph from Energy Impact Partners, I’m looking at Jan. 2018 to the present day:

Climate tech earns the trophy.

The EIP Climate Tech Index (dark green line) is up 148%.

The NASDAQ is up just 67%.

—

On this third graph from Energy Impact Partners, I’m looking at Jan. 2014 to the present day:

The story is reversed. Climate tech must remember that its glory days have just begun.

The EIP Climate Tech Index (dark green line) is up just 70%.

The NASDAQ is up 180%.

🎤 3 podcasts from me to you.

Check out three of the latest podcasts from Entrepreneurs for Impact:

(1) More profitable solar farms to power data centers

(2) $700M for climate tech startups

(3) $157M for EU-based climate tech startups

Soluna Computing is a NASDAQ-listed public company that builds smarter, small-footprint data centers to buy and use excess renewable power.

John Belizaire is the CEO of Soluna Computing and a serial entrepreneur who sold his first company at age 28 for $150 million.

—

The Westly Group was founded in 2007 and has four venture capital funds with over $700 million under management. They have become one of the premier venture investors in North America focused on energy, mobility, buildings, industrial technology, and cybersecurity. They invest $5-$15M per company, and one of their nine IPOs includes Tesla. Check out their portfolio here: https://westlygroup.com/portfolio

Tim Wang joined the Westly Group in 2015 and helps manage the firm’s deal flow and due diligence process. Prior to joining the Westly Group, Tim was a co-founder and Head of Business Development at a China-based financial technology start-up, ChinaScope.

Tim began his career as an analyst at S&P Capital IQ, a leading financial data provider for financial institutions and advisory firms. Tim worked with the Client Development team out of their New York office before moving to Hong Kong to lead their Asia go-to-market efforts and build a team that would manage relationships with all of Capital IQ’s clients in the region.

Tim holds a BA in International Relations from Brown University and an MBA from the USC Marshall School of Business.

—

Climentum Capital invests from a $157M fund into late seed and Series A rounds in European startups that can reduce megatons of CO2 equivalents. With initial ticket sizes ranging between 1 and 5 million EUR, they are building a portfolio of 25 companies.

Yoann Berno is a General Partner at Climentum Capital, a mentor with Breakthrough Energy Fellows, a software engineer, and a former cofounder at Catalyst (Enable), Angels Partners, and Supernova.

🏗️ New $500 million fund for climate tech + real estate.

Big congrats to Fifth Wall for their new half-billion-dollar fund focused on investing in software, hardware, renewable energy, energy storage, smart buildings, and carbon sequestration technologies to decarbonize the $10.5 trillion real estate industry.

This is especially gratifying to see because when I got my PhD in green building and worked in real estate private equity many years ago, green real estate was a topic of constant debate and doubt — "Wait, doesn't it cost more? Delay projects? Scare away tenants?"

Oh, how things have changed. Finally.

Kudos to the Greg Smithies and the whole team!

I'm excited to more portfolio companies like Sealed — led by Lauren Salz, Cofounder and CEO, and member of our Climate CEO peer groups at Entrepreneurs for Impact — continue to grow and solve big problems and capitalize on huge opportunities like residential energy efficiency.

Learn more about Fifth Wall’s fund here:

⛅ Doom and gloom are not the answer to mainstreaming climate change.

When I majored in environmental science 25 years ago, I was good at being a buzz kill.

Me — “Do you know how that cheeseburger contributes to rainforest destruction?”

My former friends — “Uh, no. But it’s delicious. Can you go sit over at that other table?”

I started to hate talking about environmental problems.

I wanted to focus on environmental solutions.

That’s what led me to green real estate private equity. And now to leading climate CEO peer groups.

Such potential. So much optimism. So energizing.

If this resonates with you, then you might like this new piece by Noah Smith:

How we will fight climate change — And how we will not fight climate change

In contrast to the “failed strategies focused on degrowth, anticapitalism, and doomerism,” he argues for a “strategy that will work — a technology-focused, bottom-up, whole-of-society effort.”

He continues…

It is not the language of sacrifice — it’s the language of abundance.

It’s not some fantasy of socialist utopia — it’s cheap good stuff you can buy right now.

It’s not a dire, angry, hectoring leftism that demands sacrifice under threat of destruction — it’s a positive, can-do individualist progressivism that’s in keeping with the way America has improved itself in the past.

Beating climate change is part of the Abundance Agenda.

This is our Plan B, but as Robinson Meyer writes, it’s not such a bad fallback.

In fact, it sounds like a pretty fun social movement to be a part of.

A heck of a lot better than sitting around waiting to die in a fire, anyway.

I’m in.

💀 Want to meditate with a dead nun’s body?

Sound grim?

Maybe.

But that’s what I did about 20 years ago in a Thai Buddhist monastery on an island in the Gulf of Thailand.

I wore an orange robe. Slept on a concrete floor. Begged for alms barefoot at 5:00 am. Meditated until my legs felt disconnected from my body.

And…

Contemplated the impermanance of life by meditating with the mummified body of a former nun of the monastery.

Even more shocking…

This deceased nun was the mother of the same cheerful nun who had onboarded me to my stay in the monastery.

That nun wanted her decaying body to continue to teach future seekers how to find the meaning of “Be. Here. Now.”

I guess that’s why they call this a “meditation practice.” I am NOT where this nun is.

According to this end-of-life expert, “Many monks actually carry photographs depicting deaths or bodies in various stages of decomposition…It makes one ask, ‘Am I making the right use of my scarce and precious life?’”

That’s all, y’all.

Make it a great week, because it’s usually a choice.

— Chris

🌎 P.S. Come learn climate tech startup funding with me

I’m launching the second cohort of my live, cohort-based course in September => “Fund Your Climate Tech Startup.”

With a small group of around 20-25 entrepreneurs (preseed and seed stage) and career-switchers, it’s very hands-on and practical. It includes:

500+ climate investor list (with emails)

Frequent pitch practice with peer feedback

5-step process for raising capital

9-step method for improving your 1-page business plan

7 tools for assessing your competitive edge

20 top startup mistakes to avoid

—

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

We help CEOs and investors tackle climate change with mastermind peer groups, online courses, newsletters, and podcasts