🤫 11 tips for raising climate tech capital

3-minute summary of climate tech, better habits, and deep work

Good morning, folks.

In today’s 3-minute read, we’ll cover these 5 juicy nuggets below — as satisfying as a steaming hot tub in a frigid snowstorm.

Climate Startups & Investment

#1 — 💰 These 11 tips can help you raise climate tech capital.

#2 — 🧆 Do you know these 12 women in sustainable food systems?

#3 — 🏃♀️ Run away from the money.

Productivity & Living the Good Life

#4 — 🎨 Diversity can boost profits. But we’re still failing.

#5 — 😌 Another epidemic: Lack of appreciation.

Onward and upward,

Chris

#1 — 💰 These 11 tips can help you raise climate tech capital.

If some of these seem obvious, good. If not, great.

Stay lean instead of raising large — Ignore the ego.

Get a lead investor who focuses on your stage — Be their focus, not their experiment.

Optimize for the investment partner, not price — Think outcome, not dilution.

Bring multiple great investors into the deal — You want networks, not just capital.

Build relationships for the next round during this round — Always. Be. Raising.

Target climate-focused firms — This world is getting bigger: 613 investors invested in 5 or more climate deals last year.

Emphasize the economics — There is no sustainability (of the venture) without revenue and profit.

Design a compelling narrative — Humans are 22x more likely to remember something if it’s told in a story.

Build and leverage relationships — We like to do business with people we know, like, and trust.

Consider all funding options — VC, project finance, grants, debt, DAFs, oh my!

Get “The Holloway Guide to Raising Venture Capital” — 778 links and references.

Shout out to Tommy Leap for his work (in bold) on these in 2023 and 2020.

#2 — 🧆 Do you know these 12 women in sustainable food systems?

It’s time for Greenbiz to share its annual list of “badass women” leaders in sustainability. Love it. 💪

Barbara Guerpillon

Senior Director Ventures, Transformation & Sustainability, Dole Sunshine Company

Perteet Spencer

Co-Founder, Ayo West African Foods

Danielle Nierenberg

President, Food Tank

Arohi Sharma

Deputy Director; Regenerative Agriculture, Nature Program, Natural Resources Defense Council

Nina Mannheimer

Chief Product Officer and Co-Founder, Klim

Laura Lee Cascada

Campaigns Director, Better Food Foundation

Julia Person

Sustainability Manager, Bob’s Red Mill

Carmen Burbano

Director, Food Based Programmes Division, World Food Programme

Ahrum Pak

CEO and Co-Founder, WNWN Food Labs

Corey Ramsden Scott

Livestock Sustainability Services Lead, Truterra

Rasha Hasaneen

Vice President, Innovation and Product Management Excellence, Trane Technologies

Catherine Musulin

Head of Sustainability, Meati Foods

👀 Question for you? 👀

Who else should be on this list?

Let me know on LinkedIn by reposting this newsletter and adding a “badass woman” leader that you love in the comments. 🎤

#3 — 🏃♀️ Run away from the money.

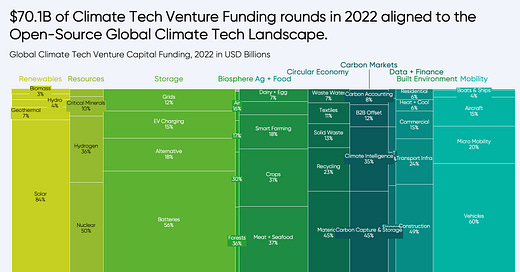

The graph below shows where most climate tech VC money went last year.

The strategic question is this. Should you:

(1) invest, or launch ventures in, the categories that received the most capital — i.e., solar, batteries, and (electric) vehicles?

Or…

(2) run in the other direction, away from the crowds, trying to find where the “hockey puck will be” in 4-6 years?

The answer?

Yes.

Check out more graphs here.

#4 — 🎨 Diversity is awesome. Oh, and it can boost profits, too.

In 2020, I wrote a short article summarizing the clear business benefits of diversity.

Here we are in 2023. It’s still relevant.

Some snippets:

"Companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile — up from 15% in 2014.”

For top-quartile companies in terms of ethnic and cultural diversity, this profitability outperformance was 36%.

“More diverse companies were 45% more likely to report annual market-share growth and 70% more likely to enter a new market.”

"In an analysis of the 3,000 largest public companies, researchers found that more heterogeneous firms were more innovative and got more products to market than less diverse ones.”

Read the full article here.

#5 — 😌 An epidemic: Lack of appreciation.

How often do we say the following?

“Thank you.”

“I appreciate the way you __________.”

“Your superpower is __________.”

According to the research, not very often. 🥺

Only 20% of employees feel strongly valued at work.

79% of employees who quit their jobs claim that a lack of appreciation was a major reason for leaving.

40% of employees say they feel unrecognized for the work they’ve been doing during the pandemic.

Want a good return on investment?

Invest in a few authentic words of appreciation.

Our work and personal relationships might be transformed. 🤯

That’s all, y’all.

Make it a great week, because it’s usually a choice.

Cheers,

Chris

—

Chris Wedding

Founder @ Entrepreneurs for Impact

Climate CEO peer groups | My Podcast