$1.8 Billion for Fusion Energy | 65 climate OKRs from billionaire investor | $500 gift for every employee's health

Plus, 75% of investors increased diligence on ESG, Saudi Aramco wants us to invest more in fossil fuels, and what would it look like if it were easy?

Good morning, folks.

Welcome to the ZERO newsletter from Entrepreneurs for Impact.

As the holidays approach, I’ll plant this seed with you.

One of our Climate Mastermind peer group members has decided to give their employees $500 towards health and wellness expenses of their choice in 2022. That might include new gym memberships, an indoor training bicycle, yoga classes, meditation retreats, etc.

What do you think their ROI on this generous gift (uh, investment) might be? Might guess is pretty high.

Cheers,

Chris

$1.8B Series B for fusion energy.

Yes, that’s billion, not million.

And, yes, it’s for fusion, not fission.

Commonwealth Fusion Systems (CFS) is the name. Don’t forget this one.

How could this be relevant to you?

If you’re raising capital for FOAK (first of a kind) financing, then their list of investors could be on your list.

The round was led by Tiger Global Management with participation by new investors, including (in alphabetical order) Bill Gates; Coatue; DFJ Growth; Emerson Collective; Footprint Coalition; Google; JIMCO Technology Fund, part of JIMCO, the Jameel Family’s global investment arm; John Doerr; JS Capital; Marc Benioff’s TIME Ventures; Senator Investment Group; a major university endowment; and a pension plan; as well as current investors, including Breakthrough Energy Ventures; The Engine; Eni; Equinor Ventures; Fine Structure Ventures; Future Ventures; Hostplus; Khosla Ventures; Lowercarbon; Moore Strategic Ventures; Safar Partners; Schooner Capital; Soros Fund Management LLC; Starlight Ventures; Temasek; and others committed to the commercialization of fusion energy to mitigate climate change.

Here is more from their press release.

CFS’s path to commercial fusion energy:

2018: Company founded based on decades of MIT fusion research

2020: Published a series of peer-reviewed publications in the Journal of Plasma Physics that verifies SPARC will achieve net energy from fusion

2021: Started construction on campus that will host the SPARC building, a manufacturing facility, and company headquarters

2021: In collaboration with MIT, built and successfully demonstrated groundbreaking high-temperature superconducting magnets, the strongest of their kind and the key technology to unlock commercial fusion energy

2025: SPARC achieves commercially relevant net energy from fusion

Early 2030s: First fusion power plant, called ARC, is completed

Fingers crossed. We all need them to succeed.

Increasing investor scrutiny of fund managers in terms of ESG.

The graphic below comes from EY’s recent report — 2021 Global Alternative Fund Survey.

In summary:

75% of investors have increased their diligence on fund manager’s ESG (Environment, Social, Governance) practices, or lack thereof

39% of investors have decided to NOT invest with a fund manager because of their inadequate ESG policies and procedures or to give them strong suggestions (e.g., “If you don’t do this, then I won’t invest.”).

Oh, how different this is compared to a closed-door investor meeting I took part in after a SuperReturn conference in Berlin a few years back.

We had all been speakers at the event, and we were debriefing on trends and observations.

The contempt for and jokes about ESG investing were as abundant as the science confirming we’re on track for a toasty and tortured future if we don’t course correct.

What a welcomed 180-degree-reversal in such a short time period. Now, we just need a lot more of those in every industry and country on Earth. No biggie.

Saudi Aramco CEO: Social unrest if fossil fuel investment ends too quickly.

The CNBC summary further describes his comments at the World Petroleum Congress in Houston, Texas, on Monday:

Amin Nasser urged global leaders to continue investing in planet-warming fossil fuels in the years ahead.

Is this too predictable to be news?

Probably.

What’s he reacting to?

The International Energy Agency in May warned that investments in new oil and gas projects must immediately stop in order for the world to achieve net-zero emissions by 2050 and avoid the worst consequences of climate change.

What do recent trends show?

The biggest banks have poured $3.8 trillion into fossil fuels since 2016 (when the Paris Agreement was signed).

Sigh…

This billionaire investor has 65 climate OKRs for you.

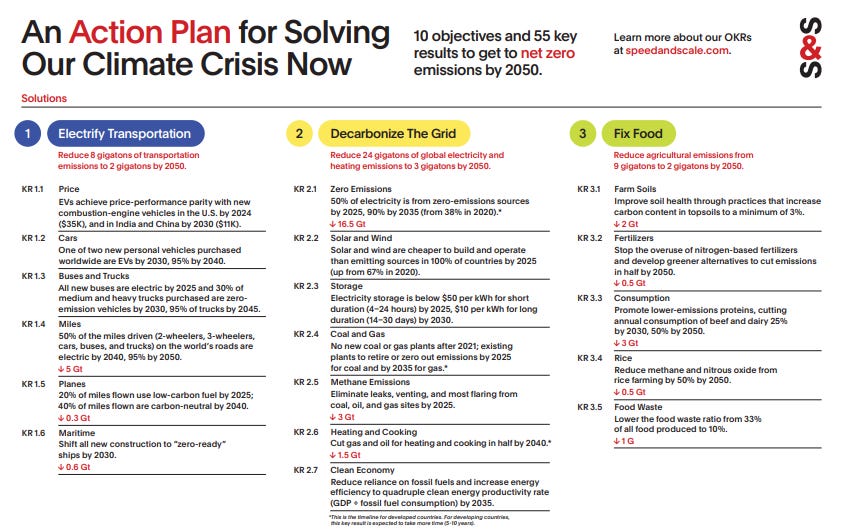

John Doerr, Chairman of VC firm Kleiner Perkins, has a new book out — Speed & Scale: An Action Plan for Solving Our Climate Crisis Now.

It lays out 10 objectives and 55 key results to get to net zero emissions by 2050.

On one hand, ho-hum, we’ve heard some of this before.

On the other hand, thank you! The simplicity and action-oriented nature of the book and this two-page summary are refreshing.

Here’s their blurb, in case you need a Christmas gift for the world-changers in your life.

What if the goal-setting techniques that powered the rise of today's most innovative organizations were brought to bear on humanity's greatest challenge? Fueled by a powerful tool called Objectives and Key Results (OKRs), SPEED & SCALE offers an unprecedented global plan to cut greenhouse gas emissions before it’s too late. Used by Google, Bono’s ONE foundation, and thousands of startups the world over, OKRs have scaled ideas into achievements that changed the world. With clear-eyed realism and an engineer’s precision, Doerr identifies the measurable OKRs we need to reduce emissions across the board and to arrive by 2050 at net-zero—the point where we are no longer adding to the heat-trapping carbon in the atmosphere.

By turns pragmatic and inspiring, SPEED & SCALE intersperses Doerr’s wide-ranging analysis with firsthand accounts from Jeff Bezos, Christiana Figueres, Al Gore, Mary Barra, Bill Gates, and other intrepid policy leaders, entrepreneurs, scientists, and activists. A launchpad for those who are ready to act now, this book is geared to leaders in every walk of life. With a definitive action plan, the latest science, and a rising climate movement on our side, we can still reach net-zero before it is too late. But as Doerr reminds us, there is no more time to waste.

The richest family: On humility and giving.

In this podcast below, I learned how the Rothschilds family became the wealthiest in history (maybe) via a global banking empire.

But what stood out to me was something different.

The chief entrepreneur of this dynasty, Mayer Amschel Rothschild (born in 1744), was also known for three other things:

Walking the streets at night giving out money to those in need

Continuing to live in a home (below his means) in the Jewish quarter of Frankfurt, Germany

Having boundless energy — I bet he would have loved our modern-day biohacks

Question for me (and you):

If we were among the richest families in the world — and if you’re making six figures, then that probably defines you — what else would we want to be known for?

That’s all, folks.

Make it a great week, because it’s usually a choice.

— Chris

P.S. What would it look like if it were easy?

This is a quote from my boy Tim Ferriss. (Those are my words, but maybe not his.)

Too often we think that life or work is supposed to be hard. But what if it weren’t? What systems would you need to create? What would have to be eliminated? How might your ambitions shift to make this happen?

—

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

The Only Private Executive Mastermind Community for CEOs, Founders, and Investors Fighting Climate Change