28 Climate SPAC stock prices

Plus, over 1,000 indoor agtech startups (map), cobalt and child labor (infographic), and which Native American land are you sitting on?

Climate SPACs — Share price trends for 28 companies.

In the table below, we’re tracking cleantech SPAC deals to see how their stocks are performing after the exciting headlines fade away.

What do we see re: current share prices as a percentage of peak prices?

Advanced Transportation

Average = 53%

Min. = 21%

Max = 88%

AgTech

Average = 57%

Min. = 32%

Max = 81%

Energy & Industrial Technology

Average = 55%

Min. = 46%

Max = 71%

Renewable Energy

Average = 81%

Min. = 63%

Max = 99%

Other

Environmental Services (just one company) = 72%

Sustainable Materials (just one company) = 35%

Average = 54%

If you'd like access to our working document, email us at team@entrepreneursforimpact.com. It includes a few more columns, and we’ll update this periodically.

What’s at play here?

Time elapsed from merger to present day (more time often equals lower %)

News (positive or negative) for the target company

Number of sellers creating negative momentum

Oh yeah, and tiny lil’ SPAC headlines like those below…

The SPAC Bubble Is About to Burst (Harvard Business Review)

“More than 300 SPACs need to pull that off [finding a target] this year or risk being liquidated. But with only so many quality targets to go round, and SPAC founders’ strong incentive to close deals — even at the expense of shareholder value — SPACs may well end up in a negative spiral of poor quality/bad press/tighter regulation.”

SPAC trading pops deflate as 'exuberance and greed' depart (Reuters)

“‘The frenzy and the exuberance and greed we saw a couple months ago have quickly left the market,’ said Harris Arch, SPAC Portfolio Manager at asset management firm DuPont Capital.”

“Some 294 SPACs have raised $95.7 billion so far this year, with a further 229 seeking a little over $58 billion in the pre-IPO stage, according to information provider SPAC Research.”

The Great SPAC Scam: Why SPACs Are a Great Deal for Celebrity Sponsors, But Not Companies or Normal Investors (Mergers & Inquisitions)

“SPACs launched in 2019 and 2020 have mean returns of negative 12.3% and negative 34.9% over 6 and 12 months, respectively, following merger announcements.”

So, are all SPAC mergers doomed?

Absolutely not. But to do it right, we probably need to think more about fundamentals than fanaticism.

Cobalt for batteries + child labor?

Ah, cobalt. You precious little metal.

It appears that you’re earning your namesake — "Kobolds" in German, which means “goblin” or “trouble maker.”

The rapid growth of lithium ion batteries (i.e., lithium nickel manganese cobalt oxide) means that cobalt demand is expected to surge 3x between 2010 and 2025 (McKinsey).

But its supply chain is less than ideal — child labor, corruption, crime, poverty, and hazardous artisanal mining.

For a sense of cobalt’s global movement, check out this powerful infographic from the Visual Capitalist and Fuse Cobalt. There is much more detail on their website here.

And if you can handle it, I encourage you to check out the videos from the Democratic Republic of the Congo via this in-depth Washington Post article. It will make your heart ache. And it will trigger your fight-or-flight instincts, too.

(Source: Washington Post)

If you weren’t yet convinced about the importance of transparency in supply chains, maybe this will help make the case.

To learn more about responsible cobalt sourcing, check these resources:

How investors can promote responsible cobalt sourcing practices (UN PRI)

Volvo mines blockchain to keep ethical sourcing promise (Forbes)

Responsible Mining of Cobalt (Cobalt Institute)

1,300+ indoor agtech startups.

OK, so you can’t read the map below. I know. But here’s the link so you can blow it up.

Also, I realize that there are not 1,300 logo on this map. But it’s just so enticing to pick up your fork and dig in.

First, a shout out to Chris Taylor, a Senior Consultant at The Mixing Bowl, and Michael Rose, a Partner at The Mixing Bowl and Better Food Ventures, for this delectable compilation.

Why does this sector matter?

Agriculture uses 70% of global fresh water, but indoor agtech can reduce this by 90%.

Almost 6 billion pounds of pesticides are applied to crops worldwide each year (delicious!), but indoor agriculture can reduce these to (usually) zero.

Indoor ag is not new, and it won’t remain a tiny niche. As evidence, consider the 50 years of experience with Dutch greenhouse growers who have more acres “under glass than the size of Manhattan.”

Investors are interested. The recent public offering of Kentucky-based greenhouse grower AppHarvest at a multi-billion-dollar market cap puts a giant tomato stake in the compost-rich soil. (Importantly, a big high five from one Kentuckian to another. Nice job, Jonathan.)

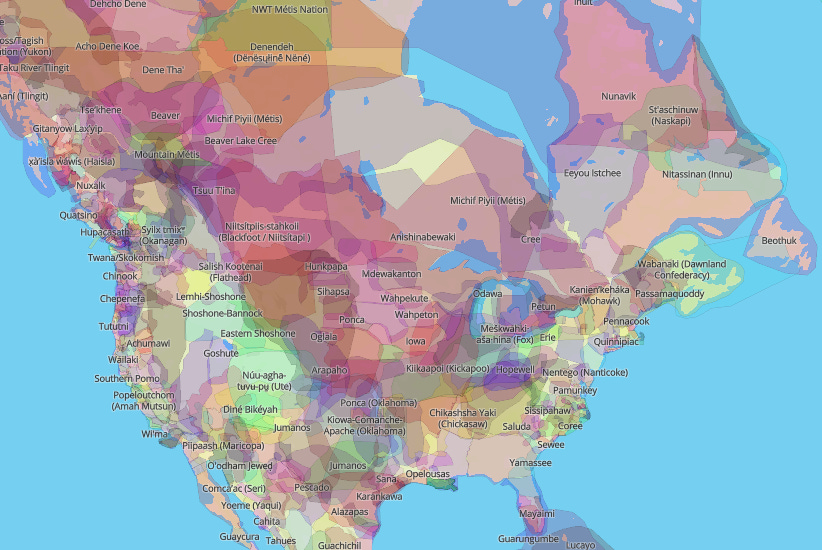

To which Native American tribe does your city’s land belong to? Here’s a map.

Have you ever wondered why there are so many hard-to-pronounce names on streets, parks, and products in your region?

Sometimes, of course, those are Native American names, and there’s a good reason for that.

This map from Native Land lets you input your city and see which Native American tribes lived on this land before Europeans arrived.

For me in Chapel Hill, North Carolina, USA, those tribes were mostly the Shakori, Lumbee, and Eno.

And to go one step further, here’s an article from The Atlantic that poses a big question:

—

Thanks to the ever delightful and insightful Julia Collins, CEO at Planet FWD*, for making me aware of this map.

* They make climate friendly snacks and software to make it easier for other companies to source climate friendly ingredients. Yum.

Got feedback?

I craft these newsletters on email-free Fridays to help you scale ventures and investments that address climate change, boost personal productivity, and become better leaders.

What do you want to see more of? Less of?

How can this be more useful (or entertaining) to read?

Feel free to respond directly to this email with 2-3 bullets before your next coffee break. (Caveman brevity is totally acceptable.)

Or connect on LinkedIn and drop me a note there.

Got a friend who might like ZERO?

I appreciate the many shares, sign ups, and emails. Keep ’em coming.

Make it a great week (because it’s usually a choice).

— Chris

P.S.

We finally gave in and launched our Climate Torch podcast on most of the platforms out there.

I invite you to listen to the first 13 episodes with these badass climate CEOs and ask, “How can I support their mission?” Plus, we’ve got a pipeline of ten more CEO interviews in the works.

And it would be awesome if you left a kind review, on your favorite podcast platform. (Pretty please with vanilla stevia on top.)

But don’t do it for my ego. (My nine-year-old daughter already has that taken care of.) Do it instead so that more folks can discover the podcast and be inspired by these climate CEO’s stories.

—

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

Peer-to-Peer Advisory Groups + Executive Coaching + Investor Intel for Climate CEOs

—

Securities offered through Finalis Securities LLC Member FINRA/SIPC. IronOak Energy Capital and Finalis Securities LLC are separate, unaffiliated entities.