🌎$300M for Industrial Decarbonization (Zero CapEx)

How to be a genius. Why biochar is so hip. Non-VC capital gets hot. Radical transparency as billion-dollar breakthrough or burnout fuel. (#180)

Welcome to my newsletter from Entrepreneurs for Impact (EFI).

I share lessons learned from working with 300 climate tech CEOs and investors to help folks become more effective climate entrepreneurs, investors, innovators, and maybe even happier human beings. 😅

Join 20,000+ folks and access 179+ prior issues.

Today’s topics:

🌿 Biochar — The carbon-negative material cooler than sipping matcha in a glass tumbler at a coastal farmers market.

💵 Non-dilutive capital had its “main character” moment in 2024.

🎙️ Podcast — $300M+ for zero CapEx industrial decarbonization.

🔬 Radical Transparency — This hedge fund calls it key to > $100B success.

🛠️ Are you a genius? Probably not. (Here’s why it doesn’t matter.)

1.

🌿 Biochar — The carbon-negative material cooler than sipping matcha in a glass tumbler at a coastal farmers market.

Move over, green smoothies and CrossFit — there's a new trendy savior in town, and it's literally as old as dirt.

Biochar, the hipster cousin of charcoal, is getting some well-deserved attention.

Why do investors care?

The market is projected to exceed $2B by 2032.

It's more versatile than your friend who claims they can play every instrument. From soil health to water filtration, biochar's got more tricks than your Uncle Steve performing magic at a kids' party.

It's the budget-friendly option for carbon offsetting with high permanence. Finally, something cheaper than your therapy sessions after watching climate disaster movies.

Who are some leading biochar startups?

Carbo Culture raised $18M to harness biomass streams as diverse as the opinions at a family holiday dinner. (Yes, that’s an analogy. They can’t turn resentment into electrons.)

Takachar's portable biochar systems are like food trucks but for saving the planet. They’ve won the Musk Foundation's XPRIZE award and the Earthshot Prize. (Daaaaang!)

Applied Carbon scored $21M for automated biochar production. Check out my Entrepreneurs for Impact podcast with their CEO, Jason Aramburu. (At that time, they were called “Climate Robotics.”)

How does biochar fight greenhouse gases?

Sequesters carbon like a ravenous teenage boy at dinner (potentially 6% of global emissions).

Reduces nitrous oxide emissions (273x worse than CO2). No more laughing gas for soil microbes.

Improves soil health so much (10-40% boost in growth) that you might start having nightmares about the 1986 movie “Little Shop of Horrors.”

🎯 So what?

So next time you're at a party, and someone asks what you're passionate about, just say "biochar."

It's guaranteed to either start a fascinating conversation or clear the room faster than a cafe employee yelling, "The Wi-Fi is down for the next few hours."

—

2.

💵 Non-dilutive capital had its “main character” moment in 2024.

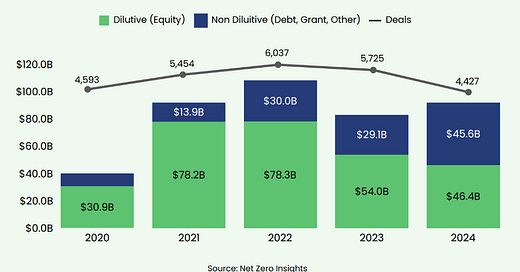

While total funding for climate tech hit $92B in 2024 — down from the party-like-it's-2022 peak of $108.3B — non-dilutive funding (debt, grants, other) jumped to $45.6B.

That's nearly half the total pie. Delicious.

And, yes, the deal count decreased from the 2022 peak of 6,037 to just 4,427 last year. (insert sad trombone tune like this).

But remember — it's about quality, not just quantity. The climate cares about what comes out of the funnel (actual solutions), not just what goes in the top (kitchen sinks, drunk ideas).

🎯 So what?

We like more debt in climate tech because…

Founders and teams own more of the value they’re creating.

Debt signals a maturing sector that’s scaling up, which we need.

Debt is cheaper than equity, which helps more projects “pencil” financially.

—

3.

🎙️ Podcast — $300M+ for Zero CapEx Industrial Decarbonization.

Arun Gupta, founder and CEO of Skyven Technologies, was my recent guest (#209) on our Entrepreneurs for Impact (EFI) podcast.

Skyven is an industrial decarbonization company that designs, funds, installs, and maintains a unique steam-generating heat pump with zero downtime and no CapEx cost to customers.

They have hundreds of millions of dollars of financing available.

As the founder and CEO, Arun is a mission-driven PhD engineer-turned-entrepreneur with prior roles at Texas Instruments and Metronics.

In this episode, you’ll learn these four important takeaways.

Why they're well positioned to serve the trillion-dollar global industry process heat market

How they price steam contracts with customers in chemicals, pulp and paper, food and beverage, ethanol, textiles, and metals

Why building for the end goal today is a bad idea, and what you should do instead

How screaming at the top of your lungs while cycling can help manage the roller coaster of entrepreneurship

🎯 So what?

Listen to the episode and share your thoughts on my LinkedIn post.

—

4.

🔬 Radical Transparency — This hedge fund calls it a key to their > $100B success.

Others call it kryptonite.

Here's how it helps or hurts performance and culture at work.

As one of the world's biggest and most successful hedge funds, Bridgewater Associates isn’t just another investment fund—it’s an empire built on its founder Ray Dalio’s focus on radical transparency.

If you’ve read the books Principles (pro) or The Fund (con), you know that at Bridgewater, everything is up for public dissection.

Here’s the breakdown of how this bold culture drives billions—but might sometimes break spirits.

Pros of Radical Transparency

Better Decisions:

Open critiques = fewer blind spots. Decisions are data-driven, not hierarchy-driven.

Idea Meritocracy:

Even interns can challenge the CEO. The best idea wins, not the loudest voice.

Accountability Rules:

Mistakes? Acknowledge them, learn, move on. Everyone owns their actions.

Cons of Radical Transparency

Emotional Toll:

Some call it “feedback.” Others call it roasting. Not everyone thrives under the microscope.

Potential for Drama:

Honesty = good. Brutality = bad. Lines blur, conflicts brew.

Scaling Woes:

Radical transparency works great in theory... until the team gets too big or too human.

🎯 So what?

Radical candor might fuel a rise to the top, but it’s not for the faint of heart.

This is only your jam if you love frequent, direct, and uber-honest feedback loops (and their book Principles).

But there's more than one path that leads to success.

—

5.

🛠️ Are you a genius? Probably not.

Me neither. That’s why we’re bad at (almost) everything. Here's why it’s okay.

The Working Genius framework is a lifesaver for startup CEOs overwhelmed by the chaos of doing too much.

Picture your startup as a chaotic potluck — everyone’s bringing a dish, but you forgot to assign roles. Now you’ve got 14 desserts, no main course, and someone’s trying to call Jell-O a salad. (Because it’s green. Duh.)

Enter the Working Genius, like a Michelin-star chef, turning your chaos into culinary brilliance.

Or at least something edible.

The idea is simple: six “Geniuses,” or ways we excel at work, broken into three acts:

Dream it

Build It

Fix It

Match people’s talents to these stages, and you’ll see productivity soar (and fewer people crying during lunch).

The Geniuses:

Wonder - Big-question dreamers. Great for pondering, bad for punctuality.

Invention - Idea creators. Love whiteboards, hate deadlines.

Discernment - Natural editors. Think Simon Cowell, but with a friendlier British accent.

Galvanizing - Pep squad leaders. Big on enthusiasm, heavy on Slack emojis.

Enablement - Helpers. They make everything possible and bring the Post-its.

Tenacity - Box-tickers. Love milestones, hate brainstorming.

(My two might be Invention and Tenacity. I should ask my wife. 😂)

🎯 So what?

Know your gaps, and stop wearing all six hats.

You’re not running a genius machine if you’re burnt out. Let the chaos turn to clarity—and ditch the Jell-O.

Learn more in this book: "The 6 Types of Working Genius: A Better Way to Understand Your Gifts, Your Frustrations, and Your Team Hardcover" by Patrick M. Lencioni

🌎 How else can I help you?

Climate CEO peer group: Capped at 100 people, representing $40B of value or assets under management. Don’t be so “lonely at the top.” No one understands CEOs like other CEOs. Find your tribe here. Join the waiting list today.

Executive coaching with me: I serve as a private thought partner to 2-3 CEOs, investors, or post-exit founders at a time. We cover business and personal opportunities for growth.

Apply at our website: www.entrepreneursforimpact.com

—

High fives and such,

Chris