🤯 $3B donation by “existential dirtbag” | Climate-related corporate risk disclosures is smart capitalism

Plus, 2 tools to boost your finance brain, the haunting sound of a real black hole, and reflecting on your 10-year-old self

Good morning, folks.

In today’s 3-minute read, we’ll cover these juicy nuggets:

📝 “Climate-related risk disclosures from companies is smart capitalism”

⛰️ $3B donation by an “existential dirtbag” #Patagonia

🤓 2 tools to boost your finance brain

🤡 What did your 10-year-old self enjoy doing?

🪐 Thank you for the haunting sound of dying souls, NASA

Enjoy.

Chris

📝 “Requesting climate-related risk disclosures from companies is smart capitalism.”

That’s according to Michael Bloomberg and BlackRock.

“Governments representing over 90 percent of global GDP have committed to move to net-zero in the coming decades.

We believe investors and companies that take a forward-looking position with respect to climate risk and its implications for the energy transition will generate better long-term financial outcomes.” (BlackRock)

“Climate risk is financial risk.

Costs from climate-related weather events now exceed $100 billion annually — and that is only counting insured losses.”

Accounting for these and other losses isn’t social policy. It’s smart investing. And refusing to allow firms to do it comes with a big cost to taxpayers.”

Any responsible money manager, especially one with a fiduciary duty to taxpayers, seeks to build a diversified portfolio (including on energy); identifies and mitigates risk (including the risks associated with climate change); and considers macro trends that are shaping industries and markets (such as the steadily declining price of clean power). (Bloomberg)

If you’re unclear about how that disclosure is done, here are two tools:

#1

TCFD — Task Force for Climate-Related Financial Disclosures

Supporters cover 89 countries and almost every sector of the economy, with an aggregate market capitalization of more than $25 trillion.

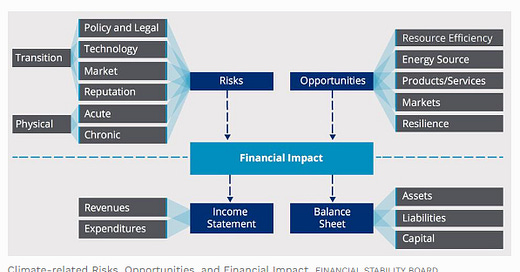

Here’s a graphic for thinking about how climate risks and opportunities funnel into the core financial statements.

#2

SASB — Sustainability Accounting Standards Board

This tool identifies the subset of sustainability issues that are most financially material to companies in 77 industries.

For a glimpse of how that work, check out their Materiality Map.

Dark grey = Highly relevant to the financial performance of the company.

Big map (hard to read):

Excerpt of the map (easier to read):

⛰️ $3B donation by an “existential dirtbag.” #Patagonia

How about both?

Let’s look at some headlines:

Meet Yvon Chouinard, the “Existential Dirtbag” Who Gave Patagonia Back to the Planet (MotherJones)

Patagonia founder's big donation potentially saves him over $1 billion in taxes — and experts say it shows how the wealthy are able to 'entirely opt out of taxes' (Business Insider)

So how did it work?

(Source: Grist)

“Chouinard, his wife, and their two adult children transferred all of the company’s voting stock, or 2 percent of all shares, to the newly created Patagonia Purpose Trust, as first reported by the New York Times.

The rest of the company’s stock has been transferred to a newly created social welfare organization, the Holdfast Collective, which will inject a projected $100 million a year into environmental nonprofits and political organizations.

Patagonia Purpose Trust will oversee this mission and company operations.

The giveaway was valued at roughly $3 billion and did not merit a charitable deduction, with the family paying $17.5 million in taxes on the donation to the trust.”

And some quotes from CEO Yvon to see how he sees things:

(Source: MotherJones)

“Earth is now our only shareholder.”

“Instead of ‘going public’, you could say we’re ‘going purpose’. Instead of extracting value from nature and transforming it into wealth for investors, we’ll use the wealth Patagonia creates to protect the source of all wealth.”

“I hope my donation “will influence a new form of capitalism that doesn’t end up with a few rich people and a bunch of poor people”.

“I was in Forbes magazine listed as a billionaire, which really, really pissed me off. I don’t have $1 billion in the bank. I don’t drive Lexuses.”

“Being a dirtbag is a matter of philosophy, not personal wealth. I’m an existential dirtbag.”

“All I ever wanted to be was a craftsman, [not a businessman.]”

“If I had to be a businessman,” I was going to do it on my own terms…Work had to be enjoyable on a daily basis. We all had to come to work on the balls of our feet and go up the stairs two steps at a time. We needed to be surrounded by friends who could dress whatever way they wanted, even be barefoot.”

“We don’t care when you work, as long as the work gets done. If you’re a serious surfer, you don’t go, ‘Hey let’s go surfing next Thursday at 2pm’—that’s what losers say.”

—

Did he save a bunch on taxes? Sounds like it.

Will he create more environmental benefits than before this move? Think so.

Could it inspire other business leaders to make similar moves? Maybe.

Am I now a Yvon groupie? After this homework, I sure am.

🤓 2 tools to boost your finance brain.

We all need this.

But if IRR, MOIC, LTV, DSCR, NOL CAPEX, YOY, or CAGR make you want to hide in a Himalayan cave…

Well, here are your metaphorical heated blankets.

#1 — 10-K Diver Twitter account

Here are some good recent posts.

“The S&P 500 lost ~194 points (or ~4.8%) this week.

If we keep losing 194 points a week, we’ll be at zero in ~20 weeks.

But if we keep losing 4.8% a week, we’ll NEVER go to zero.

That’s why fixed percentage (exponential) declines are better than fixed point (linear) declines.”

“Capitalism is brutal. Companies die all the time.

So, if we're paying up for a company, we should be reasonably sure about its LONGEVITY.

As investors, we need to cultivate the ability to identify companies that will stick around and stay strong for years and years.

So, how do we assess a business's longevity?

For this, I very much like the "Lindy Effect" concept.

This is the idea that things that have *already* stood the test of time -- by surviving/thriving for many years up to today -- are also pretty likely to survive in FUTURE.”

—

#2 — Choose FI podcast

With 15+ downloads in 190 countries, these guys are making finance interesting and approachable. Not an easy task.

That’s partly because FI = Financial Independence, and most of us want that.

Here are some sample episodes.

How Real Estate Investors Make it Work in High-Interest Environments

Time is Your Ultimate Luxury

SWOT Analysis for Financial Independence

Navigating the Possible Vs. Probable of Personal Finance

Paper Returns Vs. Real Returns

🤡 What did your 10-year-old self enjoy doing?

[It probably wasn’t spending time with creepy clowns.]

Most of us reading this newsletter are “grown-ups.”

So practical. Serious. Future-oriented.

Save for retirement. And kids’ college funds. Get an emergency fund to cover six months of cash needs. Pay off bad debt.

Boring. Boring. Boring.

What if we thought back to what we loved when we were 10 years old?

And then asked whether we’re still pursuing something similar, with gusto?

I’m not talking about kickball or video games.

But how about biking, dancing, playing in the woods, reading for fun?

If that sounds like I’m riding a unicorn-colored rainbow, hold on…

These are answers that came from some of my Climate CEO Mastermind peer group members in our meeting last week.

So what?

Be less grown-up. Buy a bike. Sign up for a dance class. Schedule hikes with friends.

YOLO, baby.

That’s all, y’all.

Make it a great week, because it’s usually a choice.

— Chris

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

We help CEOs and investors tackle climate change with mastermind peer groups, online courses, newsletters, and podcasts

🪐 P.S. NASA, thank you for the haunting sound of dying souls.

In case you missed “NASA’s Black Hole Week” — yep, it’s a real thing — here is how they kicked it off: The amplified sound of a black hole in the Perseus cluster of galaxies, about 250 million light-years away.

Some described it as the sound of “hundreds of tortured souls being dragged underneath a lake of fire."

Others likened it to “Om,” the primordial sound of the universe, considered to be a holy sound by Hindus (first) and Buddhists (later).