Good morning, folks.

In today’s 3-minute read, we’ll cover these 5 juicy nuggets below — almost as delicious as biting into that organic Georgia peach, with its juicing running down your arms on a hot July day. (I said “almost”...)

Climate Startups & Investment

#1 — 📖 New report studies 699 carbon tech companies

#2 — 🤯 We have to partner with oil and gas majors to suck CO2 at scale

#3 — 💸 3 podcasts with VC-backed CEOs and billion-dollar investors

Productivity & Living the Good Life

#4 — 🌿 The key to longevity in Greece

#5 — 😆 Startup joke for finance nerds

Onward and upward,

Chris

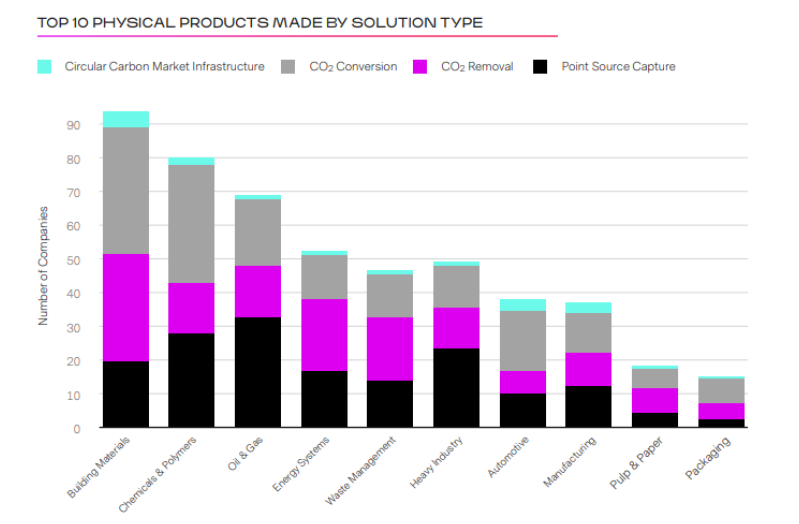

#1 — 📖 New report studies 699 carbon tech companies.

My friends at Circular Carbon Network recently released their 2022 market update on carbon capture and removal markets.

They talk about…

$5.8B invested in the sector to date

175 deals in 2022

256 investors in the space

Here’s a teaser (in graphical form):

—

—

—

Get access here.

#2 — 🤯 We have to partner with oil and gas majors to suck CO2 at scale.

When I give career advice to my Duke or UNC students, the conversation sometimes goes like this:

“You can work for a smaller, mission-focused B Corp; love [95%] of what the company does; and make X positive impact on people and planet.

Or…

You can work for a Fortune 500 company, management consultancy, or investment bank; love [60]% of what the company does; and make 10X positive impact on people and planet.

Both can be great options but know what you’re picking.”

That’s not always 100% true, but you get the idea.

Maybe the same is true here.

Since we need a gazillion more tons of CO2 sucked out of the air, we need to partner with all sorts of investors and partners, including oil and gas majors.

Not because carbon capture and removal gives them a license to continue operating their existing businesses longer. (But that’s also sometimes true.)

Instead, it’s because they have decades of experience building massive, complex engineering projects, that often involve the management of emissions into the air or liquids (compressed gases) in the subsurface geology.

That sounds a lot like carbon capture and removal.

—

The inspiration for this post came from a recent VERGE post: “To capture CO2 in the US, climate tech startups partner with oil and gas”

#3 — 💸 3 podcasts with VC-backed CEOs and billion-dollar investors.

For your commute tomorrow, here are some interviews from Entrepreneurs for Impact that I think you’ll really like — not because of me, but because of my stellar guests. 👍

Insects for Alternative Protein, from Y Combinator to a Mississippi Farm

— Trina Chiasson, CEO of Ovipost

Microsoft-backed Bio-cement and Bio-concrete from Algae

— Loren Burnett, CEO of Prometheus Materials

$1.2B for Investment in Climate Software

— John Tough, Managing Partner at Energize Ventures

///

In these podcasts, you’ll hear things such as the following:

Lessons learned from five exits netting shareholders over $375M in gains

Why Microsoft chose to invest

The reason that you shouldn’t be so concerned with your competition

Why Crossing the Chasm is a favorite startup book

How they make investment decisions using the PMTEDI model

Why “problem first, technology second” is their preferred approach

What books are on my reading stand

The surprising fact that 80% of cultures around the world eat bugs

Why there is no “single bug” solution to insect protein

#4 — 🌿 The key to longevity in Greece.

Residents of the Greek island of Ikaria live “on average ten years longer than those in the rest of Europe and the United States.” (More here)

Some people attribute this longevity to their higher-than-normal consumption of nuts, omega-3-rich fish, veggies, and garlic; manual labor; relaxed lifestyles; or naps.

Sounds delicious and delightful…

But one Ikarian explained the reason differently* —

“At every meal, we leave an extra chair open hoping that a friend or guest may join us.

It’s about relationships.”

—

* I heard this story told by Dr. Zach Bush on the Rick Roll podcast.

#5 — 😆 Startup joke for finance nerds.

“What’s the most important acronym you never hear in Silicon Valley?”

“EBITDA”

—

They say that if you have to explain a joke, then it’s not funny.

But here goes anyway.

—

EBITDA = Earnings Before Interest, Taxes, Depreciation, Amortization

It’s a measure of profit.

Why is it funny?

Because VC-funded startups typically focus on revenue growth and market share capture, not on profitability.

However, that focus may be changing because of the scary “R-word” hanging over us while we sleep.

(That’s Recession, not the Reaper. Ligten up. 💀)

🎯 That’s all, y’all.

Make it a great week, because it’s usually a choice.

⛰️ Whenever you’re ready, here are 2 ways that I can help you:

Climate CEO peer groups — The leading peer group for growth-stage startup CEOs & investors fighting climate change: Sharing best practices. Going deeper with a tribe. Removing bottlenecks to growth. Sharpening the metaphorical axe. Join the waitlist.

Podcast — 120+ interviews with CEOs and VC investors discussing climate tech, startup finance, better habits, book recommendations, and life lessons. Listen here.

Cheers,

Chris