⚡ 8 Graphs: The State of Climate Tech Investment (#192)

4 insights, 4 minutes, 400 climate CEOs & investors

Welcome to my newsletter from Entrepreneurs for Impact (EFI).

I share lessons learned from working with 400 climate tech CEOs and investors (plus 25 years of meditation practice) to help people fight climate change profitably and maybe even lead a happier life.

Join 20,000+ folks and access 190+ prior issues.

SVB just released its Future of Climate Tech 2025 report. From its 40+ illustrations, I picked 8 graphs worth extra attention.

1.

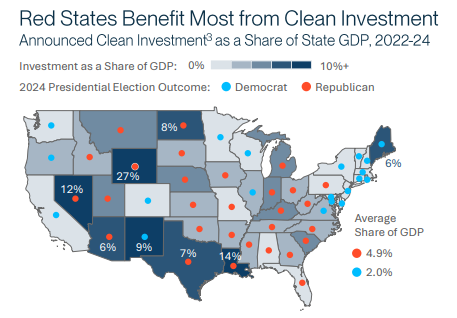

Green money. Red states.

As it turns out, some of the loudest critics of clean energy are secretly dating it, smooching behind the stadium bleachers: The ultimate political rom-com.

Pro-business Republican states know clean energy means good jobs and new tax income, not rainbows and unicorns. (But God bless them all.)

2.

CFO headaches: Now available in climate and original flavor.

Climate tech CFOs' biggest worries are not the same as those of non-climate CFOs.

But with risk comes return. Let’s deploy more capital, folks. Everything is “on sale.”

3.

Let’s pick our favorite children.

First, the sectors on the right (aqua lines) mostly get A’s, do all their chores, and make the basketball team.

Second, our kids are better than their kids.

See the orange line for decreased deal activity for the overall US VC market. Their popularity score at the high school prom is lower than ours. (“Na Na Na Boo Boo!”)

4.

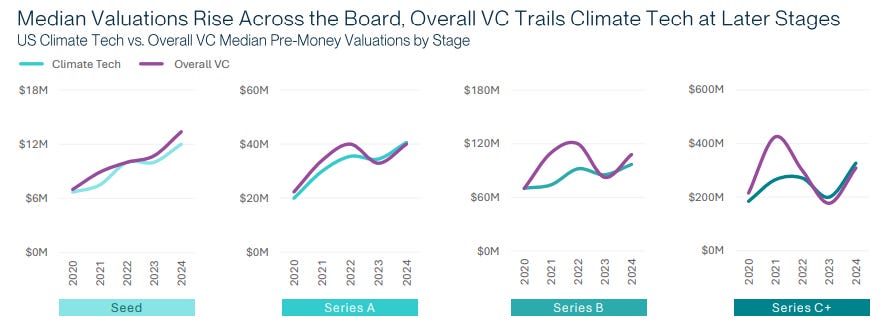

It’s tough getting old.

But the alternative is death.

With lower VC investment deal activity for later-stage companies, it’s time to get more creative with debt, project finance, vendor financing, revenue-based financing, and government grants (if those still exist).

5.

We’re rising from the ashes.

Is it time to put away the vomit bags?

Has the roller coaster stopped falling at speeds that make manly men squeal like children?

Not sure, but valuations are up from 12-14 months ago. (Though I’m not sure all CEOs would agree with that.)

6.

Who’s hot? Who’s not?

CEOs want to be on the far left (“momentum”) or far right (“scale up”) of this graph.

Investors could be anywhere:

Innovation trigger - “Let’s ride this market up!”

Disillusionment - “Time for bargain shopping!”

Slope of enlightenment - “Lower cost of capital, here we come!”

Where is your sector?

7.

My jaw dropped when I saw this.

But I fear that another part of my face might take over.

Is that salty water in the corner of my eyes? (“Dear IRA, are you leaving us so soon?”)

8.

One love (insert Bob Marley tune).

Giants in conventional energy: Hate ‘em or love ‘em, we need ‘em.

Let’s make the tent so big that it covers all types of buyers.

No exits, no investors.

That’s all, y’all.

Make it a great week. It’s usually a choice.

~ Chris

Learn more about Entrepreneurs for Impact (EFI):

Climate CEO Peer Groups - 100 members (cap), $40 billion of value

Podcast - 220+ interviews with climate CEOs and investors

LinkedIn - daily posts on climate startups, finance, and more

—

P.S. Curious about critical minerals? Check out my recent podcast. #223: Roman Teslyuk, CEO of Earth AI – $20M for AI in Critical Minerals Mining. New Drilling Technology. $10 Trillion in Global Demand. Nickel, Lithium, Silver Discoveries. Vertical Integration.