#18) Climate finance + startups (3-min. roundup)

24 "climate intelligence" startups. $160B for reforestation. 75 high promise climate seed stage co's. New US price on carbon. PCAF for financed emissions. the Mehrabian Theory.

US carbon pricing is up: $51/ton not too shabby

The Biden administration just increased the social cost of carbon to $51per ton, with methane and nitrous oxide at $1,500 and $18,000 per ton, respectively.

These could grow to $85, $3,100, and $33,000 for carbon, methane, and nitrous oxide, respectively, by 2050 if climate impacts are slapping us aside the head with a thick piece of lumber engraved with the word “Duh” on both sides.

By comparison, during the Trump administration these values were (gasp) just $1 to $7 and $55 for carbon and methane, respectively.

More from Scientific American.

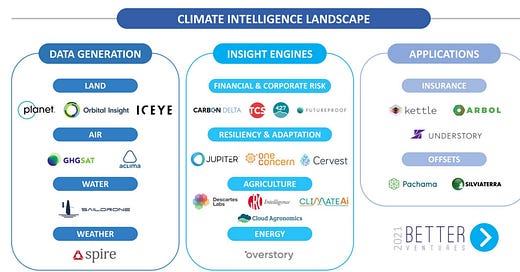

24 climate intelligence startups.

Awesome map below. ‘Nuf said.

Shout out to Jessica Eastling and the team at Better Ventures, a VC firm that “backs mission-driven founders leveraging breakthrough innovations in science and technology to build a more sustainable and equitable economy in which both people and planet thrive.”

For more intel on climate intel, read more of their analysis here.

Nature-Based Solutions to generate $800B in annual revenues by 2050?

Here are some more projections that will make you go “Hmm.” (Oh yeah, there’s a 1990 music video for that.)

“Natural forest restoration looks likely to emerge as the earliest feasible investment opportunity. The sector’s annual revenues could reach $190B by 2050.”

“Avoided deforestation may generate the remaining annual revenues with $610B by 2050, but it is further from commercialisation as it involves more complex compensation mechanisms.”

“Technical solutions, such as Direct Air Carbon Capture, Use and Storage (DACCS) and bioenergy with CCS (BECCS), could generate an additional annual revenue of $625B billion by 2050.”

To dig into the assumptions, and pray that prove to be correct, check this out:

“An investor guide to negative emission technologies and the importance of land use” — Analysis conducted by Vivid Economics for New Venture Fund and the Moore Foundation

High fives to four climate tech capital raises.

Carbon management and reduction software platform

Brendan Spellacy - CEO

$4.5M - recent raise

$5.7M - total raised

Nano engineered battery technology

Siyu Huang - CEO

$22.7M - recent raise

$53M - total raised

Advanced Refrigeration

John Fox - CEO

$2M - recent raise

$9M - total raised

Electric motor design and associated software

Ryan Morris - CEO

$80M - recent raise

$182M - total raised

The Diamond List — We love you.*

Check out this list of 75 high promise, early stage climate tech companies from the Diamond List. Importantly, it was crowdsourced from angels, accelerators, VCs, and family offices that have made at least two climate investments.

Shout out to its creators: Olya Irzak, Cassandra Xia, Zeina Fayyaz Kim, and Jeremy Brewer.

* Technically the Diamond List is not about wedding rings and romance, but more of an analog to Hollywood’s Black List — which profiles under-the-radar screenplays that have earned over $25B and have been nominated for more than 240 Academy Awards.

If you finance it, you’re [partly] responsible.

It’s called “financed emissions,” and a new standard aims to help banks assess and act on their role in climate change.

The Partnership for Carbon Accounting Financials (PCAF) just launched the first Global Greenhouse Gas Emissions Accounting and Reporting Standard for the Financial Industry.

As their Executive Director Giel Linthorst notes:

“Nearly every transaction — from individual residential mortgages to commercial real estate loans, to electricity generation project finance, to equity and debt offerings — has potential implications for GHG emissions.”

So far, 100 financial institutions with $21T in assets are aligning with PCAF.

I’m guessing that this number will skyrocket just as similar programs have — such as the United Nation Principles for Responsible Investment (UN PRI), which has gone from zero to 3,000+ financial signatories with $100T+ in assets since 2006.

More here from CFO (magazine).

Elemental Excelerator wants your advice.

With 117 portfolio companies, 71 demonstration projects, and $43M awarded to companies, this high impact accelerator notes that we have “10 years to halt the most damaging impacts of our changing planet” and wants to ask you the following:

If you could peek under the hood and grab 2 or 3 insights from Elemental's last 10 years of work, what would you want to know?

What question related to Climate Tech or equity are you currently thinking deeply about?

Ever heard of the Mehrabian* Theory?

Or perhaps its other name — 7-38-55 Rule.

It refers to how we communicate feelings and attitudes, and goes like this:

7% of meaning is communicated through spoken word

38% is through tone of voice

55% is through body language

So, when you communicate to your team, partners, and clients, which of these three modes of communication are you paying the most attention to?

Which of these three might need greater attention to improve your ability to build rapport, persuade, motivate, and empower?

Oh yeah, and if you feel your relationships are strained via too much email or Zoom correspondence, now you have even more reasons to understand why.

*Albert Mehrabian was a professor of psychology at UCLA.

What’s next?

Send me feedback (reply to this email).

What do you want to see more of? Less of?

Connect on LinkedIn (link).

I appreciate all the shares, connections, sign ups, and emails.

Keep on fightin’ the good fight, y’all.

Cheers,

Chris

P.S. — If you need some positive news every once in a while (can’t imagine why), check out the Good News Network. It’s like anti-news.

--

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

Private Roundtables, Investor Intelligence, and Executive Coaching for Climate CEOs