🌏 Guide to FOAK climate finance, Climate impacts on wealth, Raging beast vs. old turtle

+ 25 reasons for human misjudgment (#166)

Welcome to my free weekly newsletter from EFI (Entrepreneurs for Impact).

It's four short posts about climate tech startups, finance, wisdom, and a little humor.

(3 minutes)

What else can you do?

Read more — 160+ prior issues

Sign up — Join 20,000+ of your closest friends

Share it — With a friend or enemy (I’m not picky)

Find me on LinkedIn — More weekly posts

Climate Startups + Investors

1.

How to finance a first-of-a-kind (FOAK) climate project.

If you’ve been wondering about this topic for the last four years, as I have, here’s a good starter guide. It's from my friends at Breakthrough Energy.

Below are two snippets.

#1

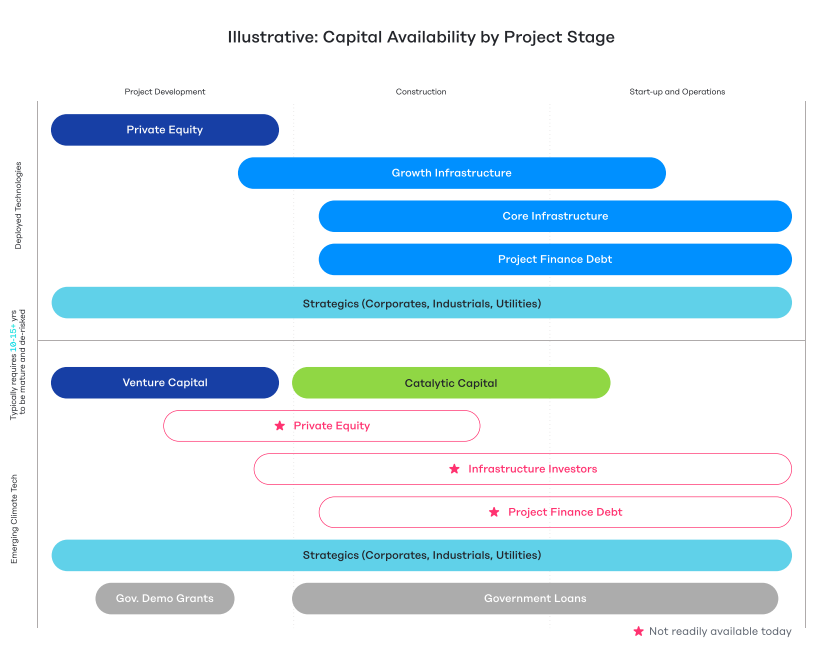

How are “Deployed Technologies” (e.g., solar, wind, batteries) financed? Lower cost of capital and far more commercial debt.

How are “Emerging Climate Tech (ECT)” projects financed? VC, catalytic capital, strategic investors, and giant gaps (see the red stars). These represent huge barriers for companies but big opportunities for innovative investors.

#2

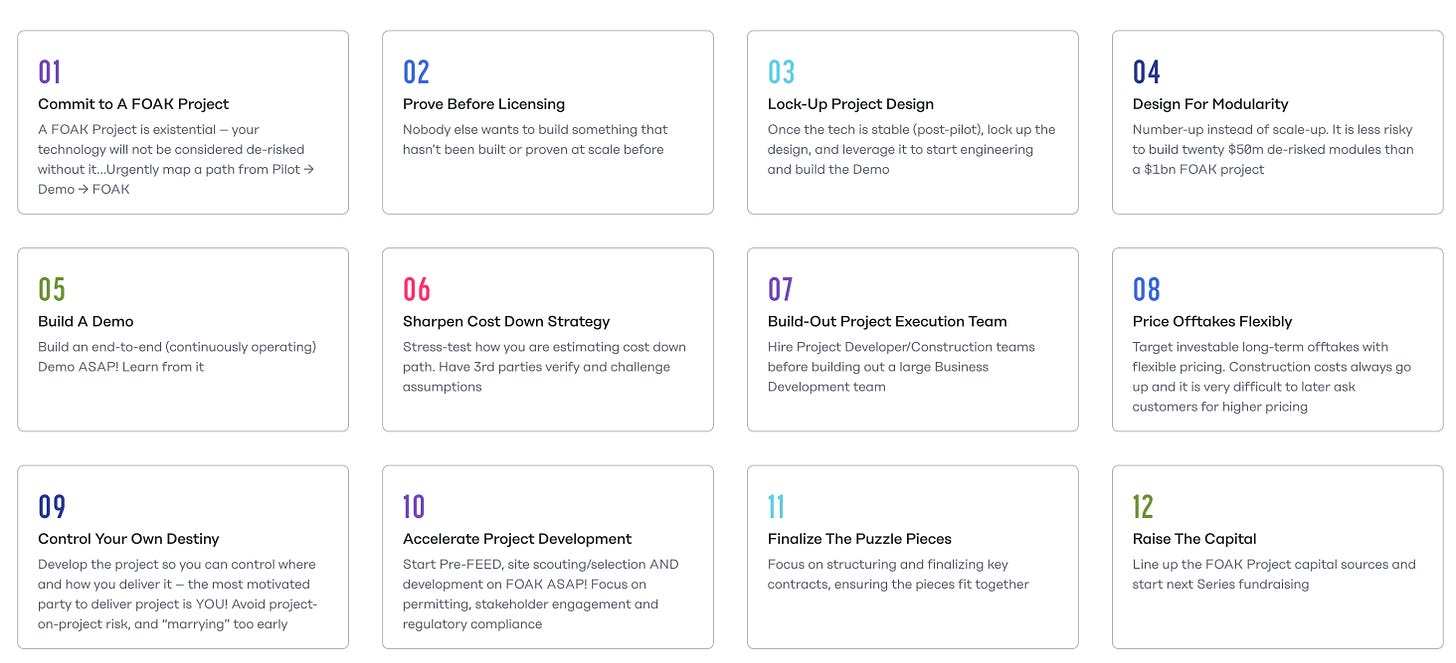

What are the 12 steps to get FOAK financing?

Simple to understand. Difficult to execute. Ignore at your own risk.

—

2.

When climate change affects wealth.

Consider this recent headline in the NYT:

Climate Change Comes to the Tetons — In one of North America’s most stunning mountain ranges, melting glaciers and warmer temperatures are raising fears of ecological tipping points.

ICYMI, Teton County is the wealthiest county in the US. This is due to its spectacular natural beauty and favorable tax and trust laws.

I can attest to the former but not the latter.

The point is this: When climate change becomes more personal, right now, then we tend to care about it more.

So, how can we make the “far off” problem of climate change matter to what people love the most?

This is especially true when engaging folks who can make change at scale.

And the answer is not “what I love most is tackling climate change” for most normal humans.

You, my dear readers, are not normal. (That’s a compliment.)

Personal Growth => Business Growth

3.

Timing is everything. And we’re not in control.

Here’s another lesson I’m trying to learn from my recent hiking in Japan.

After 2.5 hours of travel, I finally reached Tsugaike Nature Park.

So. Pumped. Up.

This was what I thought I would see.

But this is what I saw.

If I look less than blissful, you know why.

—

Similarly…

I first tried to launch our climate CEO peer groups at Entrepreneurs for Impact in February 2020.

Oops. (Thanks, Covid.)

Then, I tried again in May 2020, right before George Floyd was murdered.

Again, not the right time.

For all of us, timing is a balancing act between two modes:

Urgency vs. patience

“Raging beast” vs. “old turtle”

Which mode should you be in now?

Your answer may not be the one you want.

—

4.

25 Reasons: The Psychology of Human Misjudgment

Charlie Munger delivered these nuggets to a Harvard University crowd in 1995.

But what does he know? He was only Warren Buffett's business partner for 50+ years.

Below are four examples. Read the full list here.

Liking/Loving Tendency:

We tend to favor people or ideas we like, which can cloud judgment and lead to irrational decisions. The result? Overlooking flaws or risks in business partnerships or personal relationships.

Disliking/Hating Bias:

Individuals may also devalue the opinions or contributions of people they dislike. The result? Missing out on great ideas or insights.

Reciprocity Bias:

People feel obligated to return favors, often unsolicited. This can lead to unwise decisions. The result? Small gifts can influence customers to make larger purchases.

Commitment and Consistency Bias:

Once people commit to a belief or action, they tend to stick with it to appear consistent. This occurs even when new evidence suggests it's wrong. The result? Stubbornness and an unwillingness to change course, thereby going against our best interest.

Can I help you grow?

Join our confidential peer group for climate CEOs — 90 members, $30B of value.

Join me for executive coaching — Expand what’s possible.

Learn from climate CEOs and investors in our podcast — 190+ guests so far.

That’s all, y’all.

Make it a great week because it’s usually a choice.

~ Chris

—

P.S. Hit reply to this email (I read all responses.) Tell me what you’re frustrated by or excited about in climate tech. Maybe I’ll write about it!