It's getting hot in here — 2x valuation increase for the SOSV Climate Tech 100

Your 3-minute summary of climate tech, startups, better habits, and deep work.

Good morning, folks.

In today’s 3-minute read, we’ll cover these nuggets:

💸 2x valuation increase — SOSV Climate Tech 100 list.

🎤 Free webinar: Climate Tech Funding — Top 5 Mistakes to Avoid.

☀️ New report — How to finance a “First of a Kind (FOAK)” project.

😵 Are you an unconscious leader?

🌸 Nature is F-ing awesome.

Enjoy.

Chris

💸 2x valuation increase — SOSV Climate Tech 100 list.

That’s the kind of year-over-year growth that’ll make you want to hug a coworker.

Tightly.

But not too tightly.

But there’s more…

Total investment in this portfolio also increased 2x since last year.

These companies’ aggregate valuation and capital raised have grown to $11B and $3.8B, respectively.

Respectable, indeed.

So, who’s investing alongside SOSV in these deals?

255 investors have co-invested $1M or more with us in our top 100, up from 167 in 2021 (+53%).

The top 10 investors represented 51% of funds invested, while the top 100 represented 87.5%.

The top 10 investors by aggregate funding in alphabetical order are Abu Dhabi Growth Fund, Canada Pension Plan Investment Board, Future Positive, Hanwha International, Horizons Ventures, Kaszek Ventures, SK Group, SoftBank, Temasek, Tiger Global.

139 investors backed two or more startups in our top 100, and 16 investors funded four or more startups (up from 7 in 2021). They included Blue Horizon, CPT Capital, EF, Fifty Years, Hemisphere Ventures, Horizons Ventures, Alumni Ventures, Draper Associates, Marinya Capital, Hanwha International, Humboldt Fund, Asymmetry Ventures, and the US government’s SBIR and STTR Programs.

—

Get the full list of SOSV climate startups here.

—

🎤 Free webinar: Climate Tech Funding — Top 5 Mistakes to Avoid.

Come join me for a short discussion and live Q&A next Monday.

Across my work in private equity, investment banking, and startups, I’ve made way more than five mistakes — so there’s plenty to talk about!

— —

🎯 Time:

May 23, 2022

12:00 to 1:00 pm ET

Monday

🎯 Zoom:

https://us06web.zoom.us/j/9192747988

🎯 Cost:

Free

☀️ New report — How to finance a “First of a Kind (FOAK)” project.

Let’s say you’re a VC-backed climate tech company with $50M raised to improve and validate your secret sauce.

Hooray!

Oh, wait.

Now it’s time to scale — to build a large project using your tech.

Next, comes lots of questions with insufficient answers.

How will you get equity funding? Will you need to donate a kidney to get it?

Is debt funding possible? Will the borrowers need to also occupy a room in your home, sitting ominously with a baseball bat in one hand?

Will contractors take on the technical and reputational risk?

Luckily, this new report helps you think through more possibilities:

“Barriers to the Timely Deployment of Climate Infrastructure”

Thanks to the…

Author — Karine Khatcherian

Supporters — Prime Coalition, Schmidt Futures, Blue Haven Initiative

Advisors — Richard Kauffman, Mark Barnett, Sarah Kearney, Matthew Nordan, Johanna Wolfson, Lou Schick

Interviewees — 140+ senior members of the climate ecosystem

—

Read the FULL report.

😵 Are you an unconscious leader?

Who? Me?

No, of course not.

But let’s just check to be sure.

—

That’s where this book comes in handy — The 15 Commitments of Conscious Leadership: A New Paradigm for Sustainable Success

At our Climate CEO Mastermind peer-group retreat at Duke University last weekend, this was my small gift — or assigned reading? — for my members.

Here’s a summary of the 15 Commitments of Conscious Leadership:

Their two snippets below show how we might reset our mindset.

You can see how the “TO ME” sections sound like pretty silly ways to behave if we’re conscious of them.

🌸 Nature is F-ing awesome.

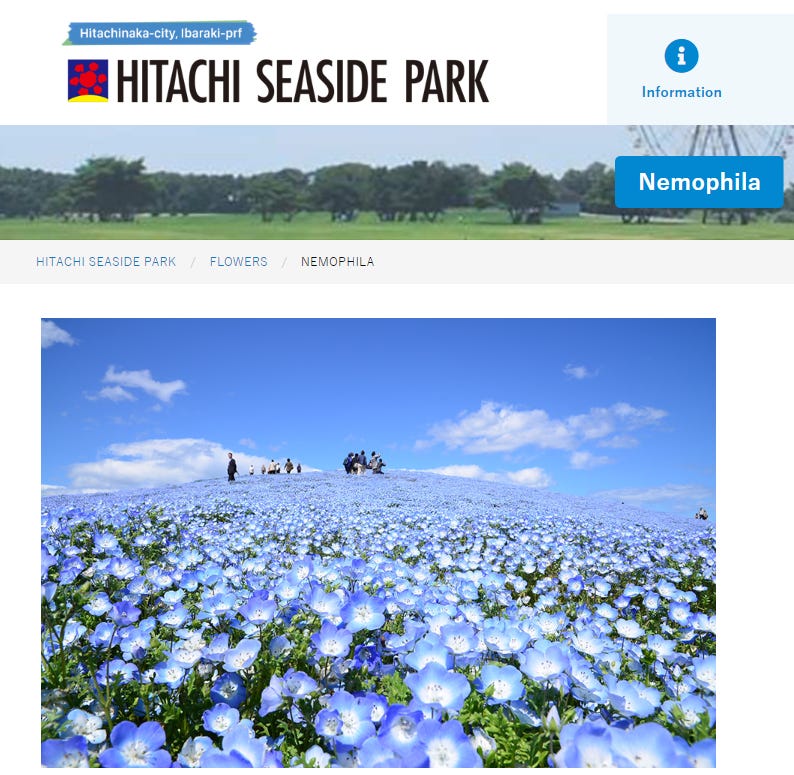

Nope, these fields of flowers below are not imaginary.

These are real photos from a park in Japan.

You’re looking at the 瑠 璃 唐 草 flower — aka, “baby blue-eyes.”

勿 論 ! Of course!

Though native to Western North America, they have found a nice home about three hours north of Tokyo.

For extra diversion from your workday, check out more flower photos here.

Why is Japan top of mind?

We lived there for three years back in the day, so it’s like a second home.

Our summer plan was to take the kids back and hang out near Kyoto for a while.

Alas, the Japanese government is not ready to let a bunch of foreign tourists back in due to Covid. 😢

残念ですね!

That’s all, y’all.

Make it a great week, because it’s usually a choice.

— Chris

Dr. Chris Wedding

Founder, Entrepreneurs for Impact

We help CEOs and investors tackle climate change via mastermind peer groups, online courses, newsletters, and podcasts