🆘 Startup Failure? 6 Steps to Recover 🌎

+ State of Climate Tech 2024 report. 40% boost in EV drive range. Mr. Rogers' life advice. (#177)

Welcome to my newsletter from Entrepreneurs for Impact (EFI).

I share lessons learned from working with 300 climate tech CEOs and investors, meditating for 25 years, teaching 90,000 students, reading 50 books per year, and being a super humble guy. 😆

Join 20,000+ folks and access 170+ prior issues.

Today’s topics:

📉 Startup Failure? 6 Steps to Recover.

🎤 Podcast — New batteries with 40% longer EV drive range.

📖 State of Climate Tech 2024 report.

🚂 Wisdom from Mr. Rogers. (Yes, the children’s TV host.)

📉 Startup Failure? 6 Steps to Recover.

My late-night call with a serial climate founder friend inspired this list.

I’m summarizing it here, hoping it helps other entrepreneurs, too.

But it’s not a post about lawyers, accountants, operating agreements, and cap tables.

Instead, it’s about the mindset and actions needed to get back on our feet.

🎯 So what?

Embrace the suck. — This Navy Seal quote has other meanings. But it works here, too. Don’t skip the anger, frustration, betrayal, or self-doubt. If you need to cry over a couple of beers alone by a campfire, do it. (Been there. Done that.) Carl Jung reminds us not to skip this step, “Our suffering comes from our unlived life — the unseen, unfelt parts of our psyche.”

Name it to tame it. — Avoid ambiguity about what’s happening inside of you. Labeling an emotion engages the prefrontal cortex, the brain region responsible for reasoning, problem-solving, and regulation of emotions. This reduces the activity of the amygdala, which is involved in the fight-or-flight response.

Become a historian. — Look backward and try to diagnose the cause of the failure objectively. Don’t just look at the last six months. Go back to the beginning. How did you contribute to the outcome that you’re experiencing today? You’re not the victim. What will you do differently next time?

Use action to absorb anxiety. — Consider running some experiments. Engage AI tools or friends (“OMG, that’s like, so yesterday, Jessica!”) to brainstorm 2-3 new career paths. Use LinkedIn to find 15 people who work in those fields. Try to get informal chats with five people per “career path.” Ask about the pros and cons of their role, company, and sector. Ask about how your skills might or might not (even better!) be a fit. Let the data speak.

Expand your timeline. — Great things take time. And if you plan to spend X years on your next venture, then taking three vs. six months to find the next thing is not an Earth-shattering amount of time. (Though I remember the stress of covering my family’s needs in my early startup days!)

Help someone else instead. — Mahatma Gandhi said that “the best way to find yourself is to lose yourself in the service of others.” I don’t want you to be “lost,” but our problems often feel smaller when we’re helping relieve someone else's suffering.

Finally, if you’re trying to figure out how to get intellectual property and climate founders from failed startups back into productive builder mode, then reach out to Dr. Virginia Emery. She’s an EFI Climate Fellow and repeat climate tech founder exploring these situations.

—

2.

📖 State of Climate Tech 2024 report.

The latest report from PwC shows trends like these.

Positive news:

Late-stage climate tech deals accounted for 80% of the total funding, showing a shift toward mature companies.

Startups in energy and industrial decarbonization saw average deal sizes increase by 35%.

Investment in carbon removal technologies grew by 45%, making it one of the fastest-growing sectors in climate tech, particularly in direct air capture and enhanced mineralization.

Less positive news:

Climate tech financing dropped 29%, from $79B (Q4 2022–Q3 2023) to $56B (Q4 2023–Q3 2024), while all VC and private equity financing flows decreased by just 16%, from $799B to $673B in the same period.

Climate tech funding as a percentage of VC and PE investment fell from 9.9% to 8.3%.

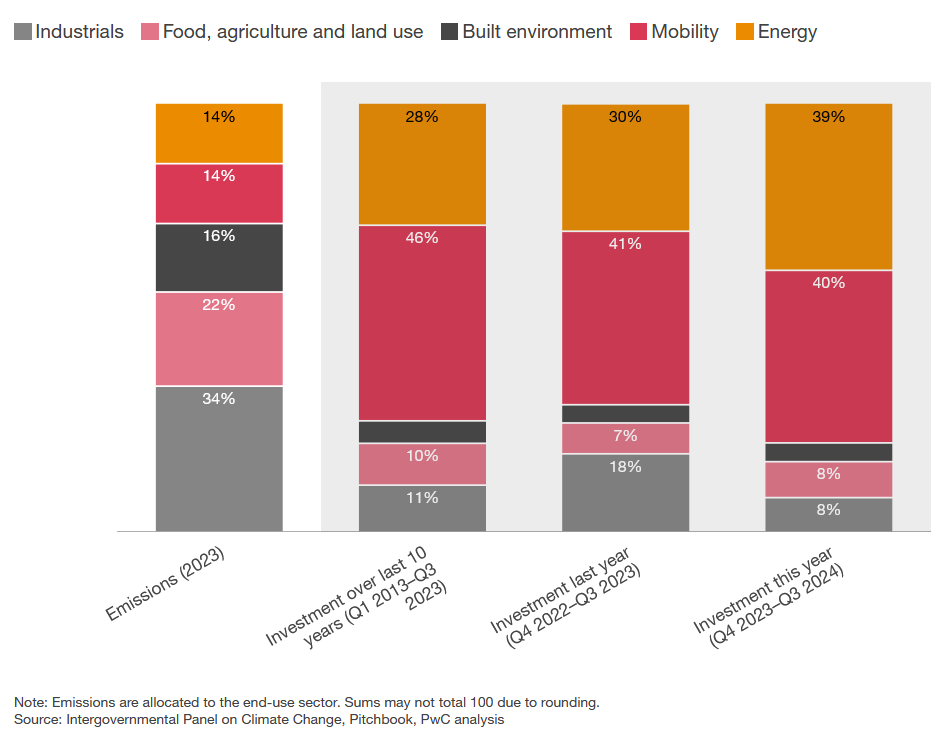

But this graph below reserves more attention.

It compares GHG emissions by sector vs. startup investment by sector.

Ideally, the percentages would be equal.

For example, if Mobility (dark pink) is 14% of GHG emissions (column on the left), then the other three columns should also show Mobility at 14%.

Instead, it received 40-46% of all investment. It’s over-invested from a GHG point of view.

In contrast, there is lonely ole’ Built Environment (dark grey) crying in the corner. 🥺

It’s starkly under-invested at 16% of GHG emissions but less than 5% from an investment point of view.

🎯 So what?

We’re not being smart in applying VC and PE capital to tackle climate change.

But wait — that’s not the real point.

The goal is to achieve good returns for investors — for example, the California teacher whose pension is invested in a climate tech VC fund.

Tackling climate change with these dollars is a hugely important, but secondary, goal.

—

3.

🎤 Podcast — New batteries with 40% longer EV drive range.

My guest on a recent Entrepreneurs for Impact (EFI) podcast was Jonathan Tan, CEO and Co-founder of Coreshell.

By producing metallurgical silicon anodes to replace graphite, Coreshell can reduce the cost of batteries by about 25% and improve drive range by about 40%.

Their collaborators include some of the biggest names in the automotive industry and the largest merchant producer of silicon metal in the Western world.

In this episode, you’ll learn these four important takeaways.

How they raised 10% of the capital of peers to reach the same milestones

Why their metallurgical silicon anode can be 20x more cost-efficient than today’s current lithium-ion battery technology

How he reduces stress by facing mortality in safe but adventurous rock climbing

Why we should focus on process vs. outcomes, and how this relates to the difference between pain vs. suffering

We’re also stoked to have Jonathan as a Climate CEO Fellow with us at EFI!

🎯 So what?

Listen to the episode here and share your thoughts on my LinkedIn post.

—

4.

🚂 Wisdom from Mr. Rogers. (Yes, the children’s TV host.)

The Mister Rogers' Neighborhood TV show was popular when I was a kid.

Starting in 1968, it ran for 31 seasons.

Recently, I heard a story about the series’ host, Mr. Rogers. It highlights wisdom from his mother. And I think it’s relevant right now.

When he was a child and would see scary things in the news, his mom would remind him: “Look for the helpers. You will always find people who are helping."

[Insert oo’s and ah’s of emotional syrup. 😏]

🎯 So what?

Avoid the doom spiral. Be the helper, the voice of optimism.

🌎 How else can I help you?

Join EFI’s private climate CEO peer group, capped at 100 people, representing $40B of value or assets under management. Don’t be so “lonely at the top.” Find your tribe here. No one understands CEOs like other CEOs.

Try out executive coaching from me for six months and get a thought partner on your business and personal challenges and opportunities for growth.

Apply at our website: www.entrepreneursforimpact.com

—

High fives and such,

Chris