⛰️ Turn CO2 into rocks to save the planet | First-of-a-kind financing model (new)

Plus, anti-greenwashing software, the "Wood Wide Web,” how old are great startup founders (data), financial returns for startup M&A or IPO

Good morning, folks.

In today’s 3-minute read, we’ll cover these delicious morsels:

🎖️ You’re the first ever? Hooray! Oh, wait…

⛰️ Turn carbon dioxide into rocks to save the planet

👵 Are you too old to lead a great startup?

💰 How much money do startups raise before a successful exit?

🧼 The anti-greenwashing software

🌳 This is not a joke — The “Wood Wide Web”

Enjoy.

Chris

🎖️ You’re the first ever? Hooray! Oh, wait…

First-of-a-Kind (FOAK) financing is one of the most challenging strategies in climate capital markets.

But don’t worry.

Here’s another way to make it work. Maybe.

Deanna Zhang* wrote a great piece to get our collective gears turning — “The case for a FOAK-focused fund.”

To start, she runs through three ways to get VC-funded tech across cross the chasm to project finance land.

Having philanthropic or government capital come in at FOAK stage, which can ‘lever’ up a project with non-dilutive financing

Pursuing a licensing model, which, with the right partner, can allow a company to scale faster with fewer capital requirements

Recruiting an evergreen fund or fund-like operating entity that can provide flexible financing at multiple stages to accelerate the scale up.

She then goes on to suggest two variants.

What if…

Hard tech VC investors were able to exit their investment in, say, year 6 instead of year 12, to a FOAK-focused fund? The MOIC (Multiples on Invested Capital) would be lower, but the IRR (Internal Rates of Return) could be higher because of a shorter hold period.

FOAK infrastructure investors could bet on a new tech before it was truly “project finance” ready, underwrite to a 30% IRR per deal, and accept two failures for every success in order to average out at a 12% IRR?

Related questions I’m thinking about…

How might new insurance products lower this risk for FOAK investors?

Do we need to solve for FOAK investors who have more than one way to win — e.g., maybe they should be strategic investors who are also selling millions of dollars of their hardware into the CapEx budgets of these projects?

Is there a way for the hard tech VC investors to have a partial exit in the hypothetical year 6 above, thereby reducing the capital costs and risk for the FOAK investor, and also recognizing potential upside after the project becomes operational?

—

Click on the image below to read more.

* Deanna is a “recovering investment banker obsessed with startups and energy transition” and founder of etechmonkey.

* Also, a big thanks to one of my rockstar Duke University MBA students, Brandon von Kannewurff, for sending this blog my way.

⛰️ Turn carbon dioxide into rocks to save the planet.

If you care about harnessing the power of Mother Nature, plus some advanced tech, to suck carbon from the atmosphere…

Check out this podcast.

Heirloom aims to accelerate the planet's transition to a carbon-negative society by removing 1B tons of CO2 from the air by 2035 by engineering the most cost-effective, scalable direct air capture system.

Their technology enhances a naturally occurring process, called carbon mineralization, to help minerals absorb CO2 from the ambient air in days, rather than years.

They are backed with $54M+ of VC funding from Lowercarbon Capital, Musk Foundation, Time Ventures, XPrize, Microsoft Climate Innovation Fund, Grantham Environmental Trust, Breakthrough Energy Ventures, and more.

Shashank Samala is the CEO of Heirloom.

Previously, he was an Entrepreneur In Residence at Carbon180 and Cofounder of Tempo (which raised $75M+ for advanced software-driven electronics production).

In this episode, we talked about:

Carbon offsets vs. carbon removal

Combining nature + engineering for quicker, low-cost direct air capture

How to use the 45Q federal tax credit to finance carbon removal projects

The evolving capital stack for carbon mineralization project finance

How key customers like Microsoft are helping them bring their tech to market

Their company culture of persistent optimism and radical honesty

Who they want to hire for high-impact jobs

And lots more

Hope you enjoy this one as much as I did.

And to support their work, consider giving Shashank and Heirloom a shout-out on LinkedIn or Twitter by sharing this podcast with your people.

Listen to the podcast here:

👵 Are you too old to lead a great startup?

Probably not.

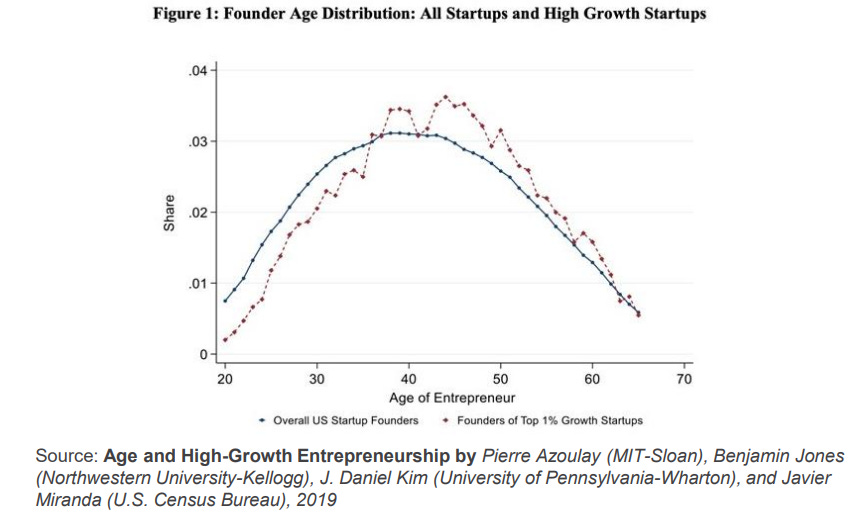

According to the data below — as highlighted by the Angel Capital Association — the most common age for founders at top high-growth startups was roughly 39 to 52 years old.

They go on…

“Across the 2.7 million founders in the U.S. between 2007-2014 who started companies that go on to hire at least one employee, the mean age for the entrepreneurs at founding is 41.9. The mean founder age for the 1 in 1,000 highest growth new ventures is 45.0.”

Does hiring one employee count as a startup in the eyes of Paul Graham, cofounder of Y Combinator? Not according to this blog.

But these numbers nonetheless still lots of worthy businesses being built.

So put on that hoody sweatshirt and start building!

💰 How much money do startups raise before a successful exit?

This is another gem from the Angel Capital Association, using data from Crunchbase.

In summary, the MOICs (Multiples on Invested Capital) are:

Median, M&A — 6.4x

Median, IPO — 4.2x

Average, M&A — 8.6x

Average, IPO — 8.6x

Sounds great. (And shocking that the two final averages show the same MOIC.)

So should we invest all of our dollars into startups?

Hold those horses. No way.

Most risky investments yield zero return. That’s why they’re called risky. (🚀 science)

This Crunchbase analysis shows that about 7% of startups have an exit, with 0.8% going through an IPO.

It’s also important to recognize that an exit doesn't mean a win. (“Dear buyer, please take this liability off of my hands. I’m tired of dumping money into a bottomless pit of despair.”)

🧼 The anti-greenwashing software.

Are you interested in balancing scope 1 and scope 2 greenhouse gas emissions with renewable energy on a 24/7 basis?

Check out this podcast.

Cleartrace is a decarbonization SaaS platform that provides the actionable data companies need to meet their renewable energy goals.

They function as an "anti-greenwashing" tool that helps corporations prove they are carbon-free on Scope 1 and 2 GHG emissions.

Investors include ClearSky, Tenaska, EDF Energy North America, Brookfield Renewable, and Exelon.

Lincoln Payton is the CEO of Cleartrace.

He is also the former Head of Investment Banking Americas and Global Head of Investment Banking Energy & Commodities for BNP Paribas.

In this episode, we talked about:

Their recent $20M raise from ClearSky, Tenaska, EDF Energy North America, Brookfield Renewable, and Exelon

How they function as an anti-greenwashing technology

The importance of temporal and geographic matching of power demand and supply in order to reach true carbon-free power

What the new proposed SEC GHG disclosure rule could mean for business

How they are currently 64 carbon markets around the world representing 23% of all GHG emissions, and where this might be headed

And lots more.

We had a good time on this one, as evidenced by the lack of serious talk the whole time. Since Lincoln is a member of the Climate Mastermind peer groups I run at Entrepreneurs for Impact, we had some inertia heading into this chat.

To support their work, consider giving Lincoln and Cleartrace a shout-out on LinkedIn or Twitter by sharing this podcast with your people.

Listen to the podcast here:

That’s all, y’all.

Make it a great week, because it’s usually a choice.

— Chris

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

We help CEOs and investors tackle climate change with mastermind peer groups, online courses, newsletters, and podcasts

🌳 P.S. This is not a joke — The “Wood Wide Web”

In summary, we don’t know sh*t about this planet. Yet.

Scientists have recently learned that under every forest there is a 500-million-year-old web of roots, fungi, and bacteria that help trees obtain and share nutrients, talk to each other (e.g., warn of dangers), and function like one larger superorganism. Check out the video here.