#106: ⭐ Use these 14 metrics to understand sustainable investment trends last week

Higher valuations for climate tech ventures, breathe like this to prevent Alzheimer’s, and do dope sh*t

Good morning, folks.

In today’s 5-minute read, we’ll cover these 6 juicy nuggets below — as satisfying as a warm outdoor shower under the stars and *not* stepping on a wet slug while walking there.

Climate Startups & Investment

#1 — 📈 McKinsey shows higher company valuation multiples for climate tech companies

#2 — 💵 VC firms managing $62B align with the UN to decarbonize their portfolios

Productivity & Leadership

#3 — 🧠 40 minutes to reduce your risk of Alzheimer’s

#4 — 🤘 “Do dope sh*t”

Recurring content (maybe; this part is new)

🏢 Climate jobs — 10 resources

📊 Sustainable finance returns — 14 metrics

Onward and upward,

Chris

#1 — 📈 McKinsey shows higher company valuations (revenue multiples) for climate tech companies

I’m excited to go long on climate tech and ESG investing.

But don’t take my word for it. What do I know anyway?

Check out this hot chart from McKinsey & Company.

(Oh yeah, that was a climate pun.)

Light blue = Investments related to climate

Dark blue = Investments across all sectors

#2 — 💵 VC firms managing $62B align with the UN to decarbonize their portfolios.

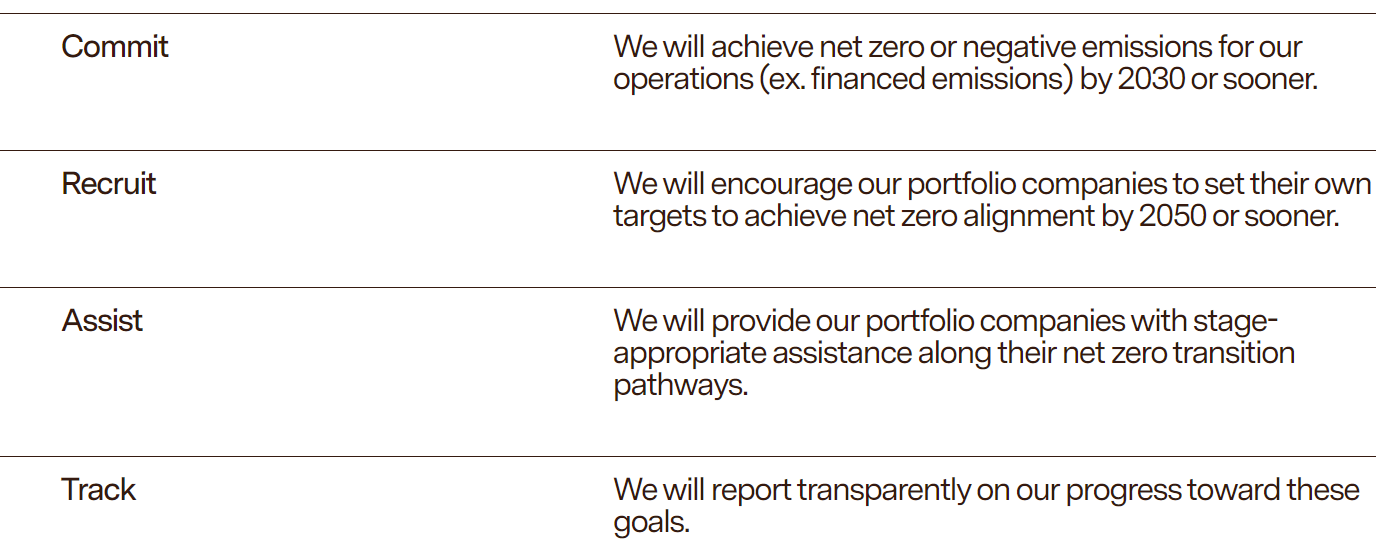

The new Venture Capital Alliance (VCA) launched last week with these goals:

—

Why does this matter?

Because of the Golden Rule — “She with the gold rules.”

(Slight variation on the religious theme.)

OK, it’s not exactly accurate: Minority investors do not call the shots for their portfolio companies. But the guidance does matter.

—

Founding members (first list) and first members (second list) are listed below.

Lots of my friends are here. Kudos, y’all!

#3 — 🧠 40 minutes to reduce your risk of Alzheimer’s.

Do you need to fork over $15,000 for a top-of-the-line sauna?

No. But that would also be nice.

Instead, research from the University of Southern California showed that this simple exercise could increase HRV (heart rate variability) and reduce levels of amyloid-beta peptides in your blood — which accumulate and aggregate in the brains of people with Alzheimer's disease.

Inhale for a count of five

Exhale for a count of five

Do that for 20 minutes, twice a day

If 40 minutes a day sounds like a lot, I get it.

But [5] more years of mental clarity at the end of life sounds pretty damn good, too.

Thanks to Doug Willmore — CEO of World Tree (an agroforestry company planting 1000s of acres of one of the world’s fastest-growing trees) and a member of our Climate CEO Mastermind peer group at Entrepreneurs for Impact — for this nugget.

#4 — 🤘 “Do dope sh*t.”

Life is too short to live a normal life. We gotta mix it up a bit.

And while I can’t say that Kanye West is my role model for life, I do like what he says through this 37-second story by Dave Chappelle.

🏢 Climate jobs — 10 resources

Check out 1,000’s of job postings here:

How to get a job tackling climate change:

📊 Sustainable finance returns — 14 metrics

Below I list the 1-month, 1-year, and 5-year financial returns (rounded) for various investment products.

(I hope I got them all right. Maybe ChatGBT should be doing this for me!)

Benchmark financial returns:

S&P 500 Index = -1%, -2%, and +49%

Dow Jones Industrial Average = -1%, 0%, and +33%

S&P 400 Mid Cap Index = -2%, -4%, and +24%

NASDAQ Composite Index = - 5%, -3%, and +62%

Russell 2000 Index = -2%, -8%, and +7%

Climate and ESG investment returns:

NASDAQ Clean Edge Green Energy = -10%, -20%, and +126%

NASDAQ OMX Solar = -8%, +18%, and +148%

NASDAQ OMX Green Economy = -2%, -10%, and +51%

NASDAQ OMX Global Water = +2 %, +4%, and +37%

EIP Climate Tech Index = -6%, -14%, and 154%

These consensus valuation metrics below are compiled by Raymond James and show how public companies are valued based on revenue or EBITDA.

They rely on 25 and 31 companies that are large and mid cap, respectively. So it’s a good representation, but not fully comprehensive.

I don’t include small-cap company metrics because the range for these multiples is too extreme.

Note: You probably shouldn’t apply these directly to private companies — unless you discount them — due to size and liquidity variances.

2023 valuation ratios (min, median, mean, max):

Enterprise value/Revenue for large-cap companies = 0.4x, 4.0x, 3.6x, and 9.6x

Enterprise value/EBITDA for large-cap companies = 3.7, 13.9, 19.1x, and 93.3x

Enterprise value/Revenue for mid-cap companies = 0.3x, 2.2x, 4.1x, and 15.5x

Enterprise value/EBITDA for mid-cap companies = 3.8x, 13.2x, 16.7x, and 48.2x

🎯 That’s all, y’all.

Make it a great week, because it’s usually a choice.

⛰️ Whenever you’re ready, here are 2 ways that I can help you:

Climate CEO peer groups — The leading peer group for growth-stage startup CEOs & investors fighting climate change: Sharing best practices. Going deeper with a tribe. Removing bottlenecks to growth. Sharpening the metaphorical axe. Join the waitlist.

Podcast — 120+ interviews with CEOs and VC investors discussing climate tech, startup finance, better habits, book recommendations, and life lessons. Listen here.

Cheers,

Chris