ZERO #17 (3-min. read)

2 climate CEO interviews. 4 climate VC capital raises. SEC and climate risk disclosure. US oil majors get S&P credit downgrade. Jeremy Grantham and bubble bursting.

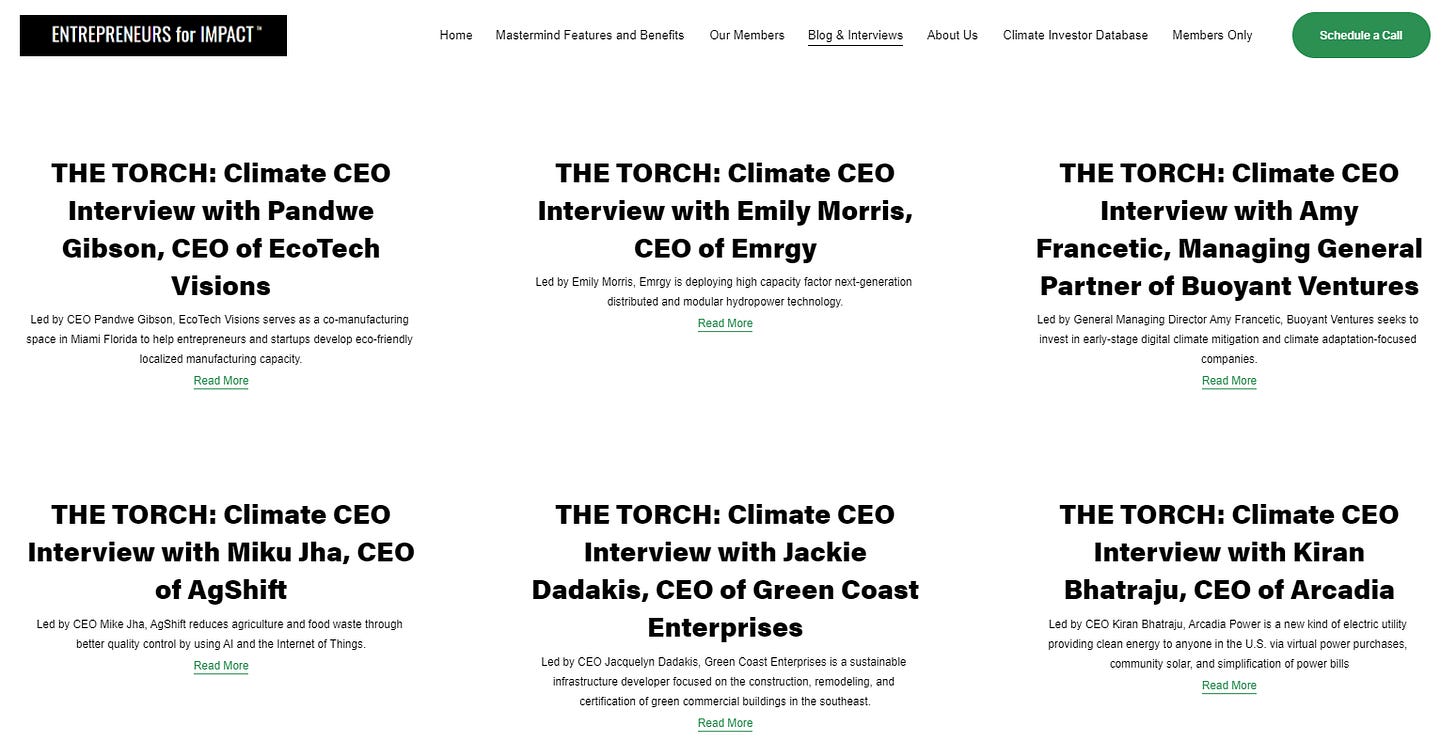

Two more climate CEO interviews with rockstar women innovators.

I hit the record button and have casual chats with awesome founders. Enjoy and let me know who you’d like me to interview next.

#1 — Distributed hydropower.

Modular units about the size of a SUV, placed into water canals (2 million mile of them globally). Predictable power with capacity factors around 50% on average, but much higher during most months. Based in Atlanta, but partnered with GE for manufacturing and global sales. Installations in multiple states with progress in multiple countries.

#2 — Distributed greentech manufacturing.

Successful serial education entrepreneur harnesses training at Harvard and MIT to turn her efforts to building a 102-location decentralized manufacturing network for greentech, spacetech, energtech, farmtech, and healthtech.

US Securities and Exchange Commission set to require more climate risk. Oh snap.

Acting SEC Chair Allison Herren Lee put it this way, “Now more than ever, investors are considering climate-related issues when making their investment decisions. It is our responsibility to ensure that they have access to material information when planning for their financial future.”

But in 2010, the SEC said that companies “should disclose how climate-related legislation and regulation, international accords, indirect effects of regulation and business trends and physical damage could impact their finances.”

Huh? Seems like that was a voice screaming alone in the wilderness.

The Treasury Department and the Federal Reserve are also paying more attention to climate risks in our financial system.

Change may not happen fast, but when it does, it could cause some whiplash in asset pricing.

US oil majors get S&P downgrade due to climate risk and earnings. Maybe they’ll “believe” in climate change now?

In their words of S&P, tighter regulations and changing demand patterns “will contribute to a more difficult operating environment for fossil fuel producers and will likely augment the risk of stranded assets and significant asset write-downs.”

Exxon, Conoco, and Chevron each took a credit hit.

To see how these long-haired hippies* in credit rating view this dynamic more broadly, check out their report — Seven ESG Trends to Watch in 2021:

—

* Oh, the sarcasm is real. Conservative folks are now on board the “green is good business” train.

Jeremy Grantham: We’re in a bubble bigger than in 2000.

This legendary investor (Co-Founder at GMO) is now 82 years old and sharper than a tack.

In this podcast — Invest like the Best with Patrick O'Shaughnessy — Jeremy delves into his predictions of the current market bubble bursting, how the SPAC craze is likely to end badly for most deals, why infrastructure investments are a great idea (the US currently get a grade of D+ in this category), his bullish views on green VC investments, and much more.

Shout outs to recent climate VC capital raises.

Enovix - CEO Harrold Rust - Advanced Silicon-Anode Lithium Ion Battery technology - $175M

Palmetto - CEO Charles Kemper - Solar Sales System Software - $80M

Malta - CEO Ramya Swaminathan - Long Duration Storage Technology - $50M

Nyobolt- CEO Sai Shivareddy - Fast Charging EV Battery Technology - $10M

We just need like $1T invested per year to hit our climate goals, so you can see that we’ve got some more wood to chop here.

Thanks to these innovators and investors for showing us how it’s done:

Big problems = big opportunities.

What’s next?

Send me feedback (reply to this email).

What do you want to see more of?

Less of?

Connect on LinkedIn (URL here).

I appreciate every share, connection, sign up, and email.

In fact, my team lovingly prints out each notification from you, frames them in the most sustainable timber possible, blesses them with an aromatic Japanese incense, parades them around town held high above their heads, and shouts your names from a giant megaphone made of algal-based bio-resin.

Keep on fightin’ the good fight, y’all.

Cheers,

Chris

P.S. — If you’re eager for space travel, but you’re not yet a billionaire, try some armchair travel to Mars via this real video footage from the Rover. The universe is big. And we are small but mighty. If we can do this, surely we can fix this planet’s crisis, too.

--

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

Private Roundtables, Investor Intelligence, and Executive Coaching for Climate CEOs